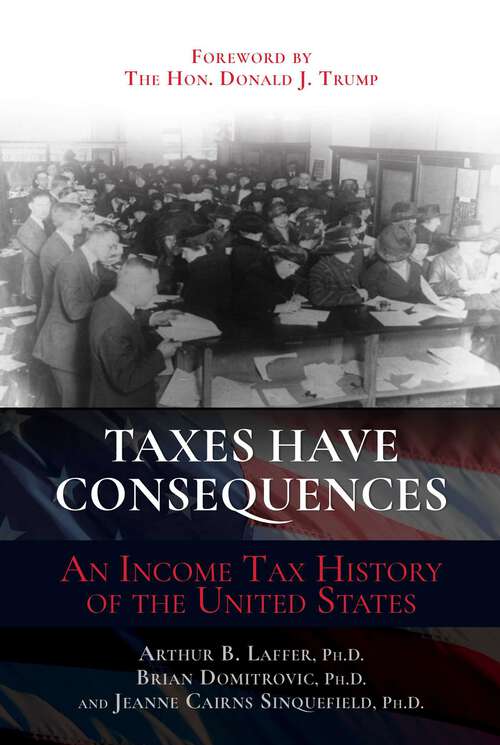

Taxes Have Consequences: An Income Tax History of the United States

By: and and

Sign Up Now!

Already a Member? Log In

You must be logged into Bookshare to access this title.

Learn about membership options,

or view our freely available titles.

- Synopsis

- The definitive history of the effect of the income tax on the economy.Ever since 1913, when the United States first imposed the income tax via constitutional amendment, the top rate of that tax has determined the fate of the American economy. When the top rate has been high, as in the late 1910s, the 1930s, 1940s, 1950s, and 1970s, the response of those with money and capital has been to curtail real economic activity in favor of protecting assets and income streams. Huge declines have come to the economy in these circumstances. The most brutal example was the Great Depression itself. When the top tax rate has been cut and held at reduced levels—as in the 1920s, the 1960s, in the long boom of the 1980s and 1990s, and briefly in the late 2010s—astonishing reversals have occurred. The rich have brought their money out of hiding and put it to work in the economy. The huge swings in the American economy since 1913 have had an inverse relationship to income tax rates.

- Copyright:

- 2022

Book Details

- Book Quality:

- Publisher Quality

- Book Size:

- 440 Pages

- ISBN-13:

- 9781637585658

- Publisher:

- Post Hill Press

- Date of Addition:

- 09/27/22

- Copyrighted By:

- Arthur B. Laffer, Ph.D., Brian Domitrovic, Ph.D., and Jeanne Cairns Sinquefield, Ph.D.

- Adult content:

- No

- Language:

- English

- Has Image Descriptions:

- No

- Categories:

- History, Nonfiction, Business and Finance

- Submitted By:

- Bookshare Staff

- Usage Restrictions:

- This is a copyrighted book.

- Foreword by:

- Hon. Donald J. Trump

Reviews

Other Books

- by Arthur B. Laffer

- by Brian Domitrovic

- by Jeanne Cairns Sinquefield

- in History

- in Nonfiction

- in Business and Finance