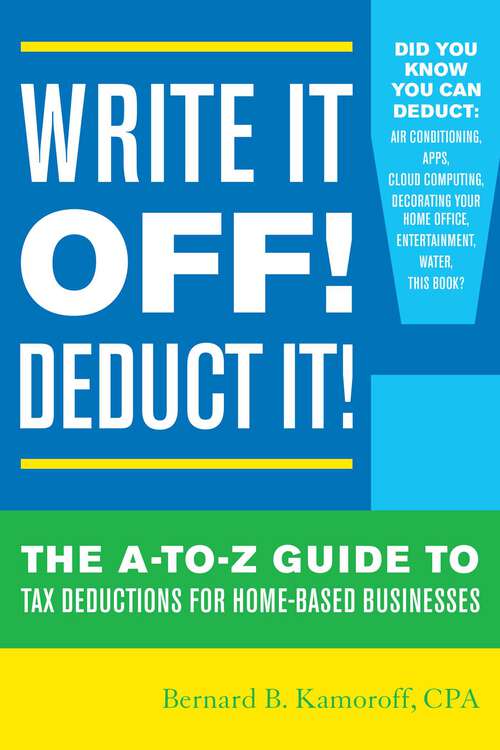

Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses

By:

Sign Up Now!

Already a Member? Log In

You must be logged into Bookshare to access this title.

Learn about membership options,

or view our freely available titles.

- Synopsis

- Are you paying more taxes than you have to? There are more than nineteen million home-based businesses in the United States—56 percent of all businesses—and they generate $102 billion in annual revenue. As far as the IRS is concerned, a home business is no different than any other business. But there is a difference: not only can you deduct the business expenses that every business is entitled to, you can turn personal, nondeductible expenses into tax-deductible business expenses—if you are careful to follow the rules. No tax software or accountant knows the details of your home-based business like you do, and the IRS is certainly not going to tell you about a deduction you failed to take. This invaluable book not only lists the individual items that are deductible in your home-based business—from utilities to that part of the home where you work—but also explains where to list them on your income tax forms.

- Copyright:

- 2015

Book Details

- Book Quality:

- Publisher Quality

- Book Size:

- 214 Pages

- ISBN-13:

- 9781630760700

- Publisher:

- Taylor Trade Publishing

- Date of Addition:

- 10/04/25

- Copyrighted By:

- Bernard B. Kamoroff

- Adult content:

- No

- Language:

- English

- Has Image Descriptions:

- No

- Categories:

- Nonfiction, Business and Finance

- Submitted By:

- Bookshare Staff

- Usage Restrictions:

- This is a copyrighted book.