- Table View

- List View

Tanishq: Positioning to Capture the Indian Woman's Heart

by Das Narayandas Kerry HermanThe firm has to choose between an established brand, Tanishq, and a new skunkworks brand, GoldPlus, to go after the Indian plain gold jewelry market: Tanishq, initially targeted at a western customer, has undergone strategic retooling and has currently been repositioned to serve the "traditional yet modern" Indian woman. The brand still carries some baggage from its past. GoldPlus, on the other hand, is a new brand that is positioned to serve the plain gold wedding jewelry market. A variety of strategic, economic, organizational and brand investment reasons make the decision an important one.

Tanked: Why the British Economy is Failing and How to Fix It

by Paul WallaceA rare book on economics that is actually written in English. Trenchant, clear and comes complete with solutions. Essential reading for the coming election. -- Simon JenkinsA lively review of Britain's economic history since the Global Financial Crisis. It is a sad story, but Wallace finds some room for hope amidst the gloom. -- Howard DaviesCrisp, comprehensive and forensic, Tanked casts an unflinching eye across the British economic horizon. The sooner we pay attention, the better' -- Tom Clark, editor of Broke: Fixing Britain's Poverty Crisis and Contributing Editor, Prospect In the autumn of 2022, Liz Truss took Britain on a journey into economic la-la land and comprehensively tanked the economy. The result? Mortgage and rents misery was piled on top of surging inflation, public debt at an eye-watering £2.7 trillion and falling living standards. As economic journalist Paul Wallace argues in this incisive, expert and accessible book, this was the low point of a once supercharged economy stuck in first gear since the financial crash of 2008. Written over ten chapters tackling the most important issues (Brexit, debt, the City, immigration, manufacturing, levelling up, public services), Wallace asks in clear, jargon-free prose what the problems are, and what we can do to solve them. He offers a ten-point plan to get our economy back on track, building on its most resilient aspects. It is vital reading for an incoming chancellor who wants a blueprint for recovery. Part-primer, part passionate argument, Tanked is the perfect book to understand how Britain has devalued itself - and how to restore its economic fortunes.

Tanked: Why the British Economy is Failing and How to Fix It

by Paul WallaceA rare book on economics that is actually written in English. Trenchant, clear and comes complete with solutions. Essential reading for the coming election. -- Simon JenkinsA lively review of Britain's economic history since the Global Financial Crisis. It is a sad story, but Wallace finds some room for hope amidst the gloom. -- Howard DaviesCrisp, comprehensive and forensic, Tanked casts an unflinching eye across the British economic horizon. The sooner we pay attention, the better' -- Tom Clark, editor of Broke: Fixing Britain's Poverty Crisis and Contributing Editor, Prospect In the autumn of 2022, Liz Truss took Britain on a journey into economic la-la land and comprehensively tanked the economy. The result? Mortgage and rents misery was piled on top of surging inflation, public debt at an eye-watering £2.7 trillion and falling living standards. As economic journalist Paul Wallace argues in this incisive, expert and accessible book, this was the low point of a once supercharged economy stuck in first gear since the financial crash of 2008. Written over ten chapters tackling the most important issues (Brexit, debt, the City, immigration, manufacturing, levelling up, public services), Wallace asks in clear, jargon-free prose what the problems are, and what we can do to solve them. He offers a ten-point plan to get our economy back on track, building on its most resilient aspects. It is vital reading for an incoming chancellor who wants a blueprint for recovery. Part-primer, part passionate argument, Tanked is the perfect book to understand how Britain has devalued itself - and how to restore its economic fortunes.

Tanking to the Top: The Philadelphia 76ers and the Most Audacious Process in the History of Professional Sports

by Yaron WeitzmanHow the NBA's Philadelphia 76ers trusted The Process -- a bold plan to get to first by becoming the worst. Including exclusive interviews with Joel Embiid, Ben Simmons, and Coach Brett Brown, Sam Hinkie, and more. p.p1 {margin: 0.0px 0.0px 0.0px 0.0px; text-indent: 36.0px; font: 12.0px Arial; color: #1a1a1a} p.p2 {margin: 0.0px 0.0px 0.0px 0.0px; font: 12.0px Arial; color: #1a1a1a} span.s1 {color: #000000} When a group of private equity bigwigs purchased the Philadelphia 76ers in 2011, the team was both bad and boring. Attendance was down. So were ratings. The Sixers had an aging coach, an antiquated front office, and a group of players that could best be described as mediocre. Enter Sam Hinkie -- a man with a plan straight out of the PE playbook, one that violated professional sports' Golden Rule: You play to win the game. In Hinkie's view, the best way to reach first was to embrace becoming the worst -- to sacrifice wins in the present in order to capture championships in the future. And to those dubious, Hinkie had a response: Trust The Process, and the results will follow. The plan, dubbed "The Process," seems to have worked. More than six years after handing Hinkie the keys, the Sixers have transformed into one of the most exciting teams in the NBA. They've emerged as a championship contender with a roster full of stars, none bigger than Joel Embiid, a captivating seven-footer known for both brutalizing opponents on the court and taunting them off of it. Beneath the surface, though, lies a different story, one of infighting, dueling egos, and competing agendas. Hinkie, pushed out less than three years into his reign by a demoralized owner, a jealous CEO, and an embarrassed NBA, was the first casualty of The Process. He'd be far from the last. Drawing from interviews with nearly 175 people, TANKING TO THE TOP brings to life the palace intrigue incited by Hinkie's proposal, taking readers into the boardroom where the Sixers laid out their plans, and onto the courts where those plans met reality. Full of uplifting, rags-to-riches stories, backroom dealings, mysterious injuries, and burner Twitter accounts, TANKING TO THE TOP is the definitive, inside story of the Sixers' Process and a fun and lively behind-the-scenes look at one of America's most transgressive teams.

Tanks on the Streets?: The Battle of George Square, Glasgow, 1919

by Louise Heren Gordon BarclayAt 12.08pm on Friday 31 January 1919, Margaret Buchanan drives her tram into George Square in Glasgow’s city center. She slows down to avoid the youths and men holding their arms up to stop her; some even jump onto the front of her tram. Swirling around her tram is a sea of heavy-coated men who have been on strike since Monday, demanding a reduction to a forty-hour working week. Crucially, the tram workers have not joined the strike; they are being abused as ‘scabs’. Constables and officers of Glasgow’s police force use their hands to try to part the crowd to allow the tram to proceed, but their efforts fail and batons are drawn. Within minutes, the violence will have spread across and beyond the Square; men will have been injured; the Sheriff will have read the Riot Act; strike leaders will lie stunned and bleeding inside the City Chambers; policemen and protestors will lie beaten in the streets. The violence and destruction in the Square, the streets to the north and south, in Glasgow Green and even south of the River Clyde, involves thousands of men. The city authorities believe the situation is beyond the control of the outnumbered police; the Sheriff sends a message to the local army commander requesting assistance. For the first time in history, tanks will be dispatched as ‘military aid to the civil power’. They will be accompanied by 10,000 soldiers. At approximately 12.30pm on Friday 31 January 1919, a century of myth-making commences. Using thousands of pages of court papers, memoirs and news reports, this book is the first attempt to tell the story of what happened in day-by-day detail.

Tanpin Kanri: Retail Practice at Seven-Eleven Japan

by Arar Han Rajiv LalToshifumi Suzuki, chairman and CEO of Seven and I Holding Co., was widely credited as the mastermind behind Seven-Eleven Japan's spectacular rise. Although Seven-Eleven Japan began as a small licensee of U.S. convenience store chain 7-Eleven, Inc. (then Southland Corp.) in 1974, it grew to become the highest grossing retailer in Japan, eclipsing its then-parent Ito-Yokado's sales. By 2005, it also owned a controlling stake in 7-Eleven, Inc. Over the years, Suzuki's emphasis on fresh merchandise, innovative inventory management techniques, and numerous technological improvements guided Seven-Eleven Japan's rapid growth. At the core of these lies Tanpin Kanri, Suzuki's signature management framework.

Tanzania The Story of an African Transition

by Roger Nord Yuri Sobolev Niko Hobdari David Dunn Alejandro Hajdenberg Samar Maziad Stéphane RoudetIn 1985, Tanzania was in severe economic distress, plagued by widespread shortages and high inflation. Agricultural production, the mainstay of the economy, had been declining steadily since the 1970s. Exports of cash crops, which traditionally accounted for the bulk of foreign exchange earnings, had fallen by half between 1970 and 1985. A foreign exchange shortage led to a precipitous drop in imports, which in turn caused a crisis in the manufacturing sector, which lacked raw materials and spare parts. Twenty years later, Tanzania looks radically different. Inflation has declined to single digits (Figure 1). Economic growth is buoyant, averaging 7 percent a year since 2000. Real per capita income has risen by 50 percent. Poverty, while still widespread, is heading downward. Exports are booming, public finances are sound, debt ratios are low (Figure 2), and foreign exchange reserves are ample. This paper is about the remarkable turnaround, the economi

Tanzania's Equilibrium Real Exchange Rate

by Niko HobdariA report from the International Monetary Fund.

Tao Te Ching

by Lao Tzu Tom Butler-BowdonA luxury, keep-sake edition of an ancient Chinese scriptureThis ancient text, fundamental to Taoism, has become a source of inspiration and guidance for millions in modern society. It's focus on attunement, rather than mindless striving, offers an alternative to command-and-control leadership and a different way of seeing personal success - a position that has led to this ancient Chinese text becoming an internationally bestselling personal development guide. Now the text has been given a makeover and this deluxe, gift edition is set to become the market leader, following in the footsteps of the other bestselling Capstone Classic editions.Includes:Paints a picture of a person in full attunementIllustrates how fulfillment and peace, without struggle, can deliver to us what we need and desireAn alternative way to view personal successA new introduction by Tom Butler Bowdon, the classic personal development expert

Tao of Charlie Munger: A Compilation of Quotes from Berkshire Hathaway's Vice Chairman on Life, Business, and the Pursuit of Wealth With Commentary by David Clark

by David ClarkWords of wisdom from Charlie Munger—Warren Buffett’s longtime business partner and the visionary Vice Chairman of Berkshire Hathaway—collected and interpreted with an eye towards investing by David Clark, coauthor of the bestselling Buffettology series.Born in Omaha, Nebraska in 1924 Charlie Munger studied mathematics at the University of Michigan, trained as a meteorologist at Cal Tech Pasadena while in the Army, and graduated magna cum laude from Harvard Law School without ever earning an undergraduate degree. Today, Munger is one of America’s most successful investors, the Vice Chairman of Berkshire Hathaway, and Warren Buffett’s business partner for almost forty years. Buffett says “Berkshire has been built to Charlie’s blueprint. My role has been that of general contractor.” Munger is an intelligent, opinionated business man whose ideas can teach professional and amateur investors how to be successful in finance and life. Like The Tao of Warren Buffett and The Tao of Te Ching, The Tao of Charlie Munger is a compendium of pithy quotes including, “Knowing what you don’t know is more useful than being brilliant” and “In my whole life, I have known no wise people who didn’t read all the time—none, zero.” This collection, culled from interviews, speeches, and questions and answers at the Berkshire Hathaway and Wesco annual meetings, offers insights into Munger’s amazing financial success and life philosophies. Described by Business Insider as “sharp in his wit and investing wisdom,” Charlie Munger’s investment tips, business philosophy, and rules for living are as unique as his life story; intelligent as he clearly is; and as successful as he has been.

Taoist Principles and Practices in Management: Success in a Multicultural Business (Business Guides on the Go)

by Waldemar SchneiderThe accelerated transformation of businesses poses major challenges to organizations. In its fundamental meaning, leadership is about a systematic way of highlighting the most important goals, combined with continuous execution along the most important principles. This book brings together key themes of Taoism, compiled for international managers who are on their way to becoming trusted leaders. After a brief outline of the guiding concepts, it discusses an application of selected teachings enriched by narratives from appropriate references and relevant verses from the Tao Te Ching (TTC). In this context, each individual yet coherent Taoist principle is applied in terms of its relevance to varying business environments.By providing embedded case studies, this book offers new ideas for managers to incorporate Taoist principles into their leadership strategies.

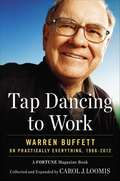

Tap Dancing to Work

by Carol J. LoomisWarren Buffett built Berkshire Hathaway into something remarkable-- and Fortune journalist Carol Loomis had a front-row seat for it all. When Carol Loomis first mentioned a little-known Omaha hedge fund manager in a 1966 Fortune article, she didn't dream that Warren Buffett would one day be considered the world's greatest investor--nor that she and Buffett would quickly become close personal friends. As Buffett's fortune and reputation grew over time, Loomis used her unique insight into Buffett's thinking to chronicle his work for Fortune, writing and proposing scores of stories that tracked his many accomplishments--and also his occasional mistakes. Now Loomis has collected and updated the best Buffett articles Fortune published between 1966 and 2012, including thirteen cover stories and a dozen pieces authored by Buffett himself. Loomis has provided commentary about each major article that supplies context and her own informed point of view. Readers will gain fresh insights into Buffett's investment strategies and his thinking on management, philanthropy, public policy, and even parenting. Some of the highlights include: The 1966 A. W. Jones story in which Fortune first mentioned Buffett. The first piece Buffett wrote for the magazine, 1977's "How Inf lation Swindles the Equity Investor." Andrew Tobias's 1983 article "Letters from Chairman Buffett," the first review of his Berkshire Hathaway shareholder letters. Buffett's stunningly prescient 2003 piece about derivatives, "Avoiding a Mega-Catastrophe." His unconventional thoughts on inheritance and philanthropy, including his intention to leave his kids "enough money so they would feel they could do anything, but not so much that they could do nothing." Bill Gates's 1996 article describing his early impressions of Buffett as they struck up their close friendship. Scores of Buffett books have been written, but none can claim this work's combination of trust between two friends, the writer's deep understanding of Buffett's world, and a very long-term perspective.

Tap Dancing to Work: Warren Buffett on Practically Everything, 1966-2012

by Carol LoomisCarol Loomis has collected and updated the best Buffett articles Fortune published between 1966 and 2012, including thirteen cover stories and a dozen pieces authored by Buffett himself. Loomis has provided commentary about each major article that supplies context and her own informed point of view. Readers will gain fresh insights into Buffett's investment strategies and his thinking on management, philanthropy, public policy, and even parenting.

Tap Into Greatness

by Sarah Singer-NourieAt some point, every single one of us has reached a point of frustration. A situation where we knew that we were having impact that was far less than what we were capable of. Large organizations are filled with smart people who have great ideas. Unfortunately, most of these people find themselves stymied in their ability to bring people to their full potential and ideas to fruition It doesn’t have to be that way. In Tap Into Greatness, noted performance coach and educator Sarah Singer-Nourie reveals the key truths of having outsized impact, influence and power. It turns out that most of us aren’t leading. We’re simply managing. We’re getting things done, but we’re not inspiring others to excel beyond what’s expected. Great leaders know better. They know leadership isn’t magic. It’s not just something you’re born with. Leadership is learnable. In this engaging and hands-on book, Singer-Nourie provides tools that have been developed over the last twenty years in her work with leaders and teams in corporate America, Silicon Valley startups, schools and non-profit organizations. The methodology is based on how people actually learn, rather than how most of us were taught in school. It leverages the insights of human motivation and the latest research in neuroscience to give leaders a roadmap for having impact. Readers who put the tools of Tap Into Greatness into practice have immediate and often surprising results. They find themselves able to influence colleagues who were previously unmoved. They’re able to inspire teammates to go above and beyond the call of duty. And they create teams that make better decisions even when the leader isn’t in the room.

Tap Your Subsidiaries for Global Reach

by Christopher A. Bartlett Sumantra GhoshalWhen Procter & Gamble launched Pampers in Europe, it directed the marketing strategy from European headquarters. The result: a big flop. In pushing new strategies successful MNCs diverge from traditional hierarchical structures in which the top formulates--and the national subsidiary simply implements--strategy and planning. By cooperating and co-opting capabilities, the parent's sales and market share get a big boost from the country unit's technical expertise, market knowledge, and competitive awareness--all without losing boundary-crossing benefits like scale economies.

Tap: Unlocking the Mobile Economy

by Anindya GhoseHow the smartphone can become a personal concierge (not a stalker) in the mobile marketing revolution of smarter companies, value-seeking consumers, and curated offers. Consumers create a data trail by tapping their phones; businesses can tap into this trail to harness the power of the more than three trillion dollar mobile economy. According to Anindya Ghose, a global authority on the mobile economy, this two-way exchange can benefit both customers and businesses. In Tap, Ghose welcomes us to the mobile economy of smartphones, smarter companies, and value-seeking consumers. Drawing on his extensive research in the United States, Europe, and Asia, and on a variety of real-world examples from companies including Alibaba, China Mobile, Coke, Facebook, SK Telecom, Telefónica, and Travelocity, Ghose describes some intriguingly contradictory consumer behavior: people seek spontaneity, but they are predictable; they find advertising annoying, but they fear missing out; they value their privacy, but they increasingly use personal data as currency. When mobile advertising is done well, Ghose argues, the smartphone plays the role of a personal concierge—a butler, not a stalker.Ghose identifies nine forces that shape consumer behavior, including time, crowdedness, trajectory, and weather, and he examines these how these forces operate, separately and in combination. With Tap, he highlights the true influence mobile wields over shoppers, the behavioral and economic motivations behind that influence, and the lucrative opportunities it represents. In a world of artificial intelligence, augmented and virtual reality, wearable technologies, smart homes, and the Internet of Things, the future of the mobile economy seems limitless.

Tape Reading and Market Tactics: The Three Steps To Successful Stock Trading

by Humphrey B. NeillIn this 1931 Wall Street classic, author and noted economist Humphrey B. Neill explains not only how to read the tape, but also how to figure out what's going on behind the numbers.Illustrated throughout with graphs and charts, this book contains excellent sections on human nature and speculation and remains a classic text in the field today.

Tapestry Networks

by Karthik Ramanna Matthew ShafferTapestry Networks assembled industry leaders and their regulators in small, private meetings to build new frameworks for pressing regulatory challenges. Tapestry's motivating principle was to reimagine solutions to complex problems (e.g., drug-approval standards) in ways that created a win-win for firms and society. Tapestry meetings on bank-governance standards-initiated after the 2008-2009 Financial Crisis-had experienced some success in rebuilding trust between regulators and banks. But, five years on, the initiative faced important challenges. First, as the urgency of the Financial Crisis faded, it was becoming more difficult to show concrete successes, particularly to the meetings' sponsors-one participant described Tapestry as "sculpting fog." Second, participants differed on what they wanted to get out of the meetings-with some participants less focused on the meetings' broader social objectives. Third, Tapestry faced lingering questions about the meetings' legitimacy and whether they facilitated greater "coziness" between regulators and the regulated.

Tapfere Helden in der Akquise: Wie Sie mit Mut und Spaß neue Kunden gewinnen

by Stephan Magnus Hans VialonEgal, ob es um Besuchstermine oder Interesse an einem Produkt geht, Anrufe bei potenziellen Kunden sind für die Akquirierung unerlässlich. Doch Akquise wird meist widerwillig betrieben und ist daher wenig erfolgreich. Hier setzen Stephan Magnus und Hans Vialon an. Die zentralen Faktoren einer gelungenen Akquise lauten Vorbereitung und Persönlichkeit. Durch den Einsatz mentaler Techniken kann Akquise professionell, elegant und erfolgreich betrieben werden. Dabei sind folgende Faktoren entscheidend: z.B. die Visualisierung von Zielen oder der Umgang mit schwierigen Kunden und Stresssituationen. Akquise ist eine Herausforderung, die auch Spaß machen kann.

Tapping Financial Resources: Lessons from Social Entrepreneurship

by John Elkington Pamela HartiganThis chapter explores some of the more interesting trends in resource mobilization for social and environmental ventures, spotlighting various entrepreneurs and their experience and lessons learned.

Tapping into Altruism: Keeping Talented Women on the Road to Success

by Sylvia Ann HewlettAccording to the author, there are six essential elements that need to gain real traction if a company is to fully realize female talent over the long haul. This chapter looks at some common career drivers for women, addressing one of these essential elements: recognizing and rewarding altruism.

Tapping the Full Potential of ABC

by Thomas G. Cucuzza Joseph A. NessMany companies have used activity-based costing in onetime profitability studies. But when companies integrate ABC into critical management systems and use it to make day-to-day decisions--when they use it as activity-based management--it becomes a powerful tool for continuously rethinking and improving a business. Most managers do not realize that implementing activity-based management is a major organizational-change effort that involves a tremendous amount of work. The biggest obstacle is resistance from employees. The authors focus on two companies--Chrysler Corp. and Safety-Kleen Corp.--whose success in implementing activity-based management can serve as a model for other companies. The benefits they have reaped have been 10 to 20 times their investments in their programs.

Tapping the Groundswell with Twitter: Understanding the Power of Twitter as Part of Your Company's Social Media Strategy

by Charlene Li Josh BernoffPeople who don't use Twitter tend to write it off. What can you say in 140 characters? In fact, the richness that Twitter packs into its tiny updates is amazing. It's caught on because it's free, it's open, and it connects people and gives them power. Twitter has rapidly become a key part of the groundswell-driving, reporting on, and extending activity in everything from blogs to social networks-and given Twitter users an outsized level of influence. In this chapter, social media strategy leaders Charlene Li and Josh Bernoff show how you can turn Twitter into a potent force for connecting with your customers for any of the five groundswell strategy objectives-listening, talking, energizing, supporting, and embracing. Case studies from McDonald's and Intuit demonstrate how different companies have used Twitter to accomplish all of their social media goals. The chapter concludes with a list of must-read, practical suggestions for setting up a Twitter account for your business. This chapter was originally published as Chapter 10 of "Groundswell, Expanded and Revised Edition: Winning in a World Transformed by Social Technologies."