- Table View

- List View

Financial Modeling (3rd Edition)

by Simon BenningaToo often, finance courses stop short of making a connection between textbook finance and the problems of real-world business. Financial Modeling bridges this gap between theory and practice by providing a nuts-and-bolts guide to solving common financial models with spreadsheets. Simon Benninga takes the reader step by step through each model, showing how it can be solved using Microsoft Excel. The long-awaited third edition of this standard text maintains the "cookbook" features and Excel dependence that have made the first and second editions so popular. It also offers significant new material, with new chapters covering such topics as bank valuation, the Black-Litterman approach to portfolio optimization, Monte Carlo methods and their applications to option pricing, and using array functions and formulas. Other chapters, including those on basic financial calculations, portfolio models, calculating the variance-covariance matrix,and generating random numbers, have been revised, with many offering substantially new and improved material. Other areas covered include financial statement modeling, leasing, standard portfolio problems, value at risk (VaR), real options, duration and immunization, and term structure modeling. Technical chapters treat such topics as data tables, matrices, the Gauss-Seidel method, and tips for using Excel. The last section of the text covers the Visual Basic for Applications (VBA) techniques needed for the book. The accompanying CD contains Excel worksheets and solutions to end-of-chapter exercises.

Financial Modeling and Valuation

by Paul PignataroWritten by the Founder and CEO of the prestigious New York School of Finance, this book schools you in the fundamental tools for accurately assessing the soundness of a stock investment. Built around a full-length case study of Wal-Mart, it shows you how to perform an in-depth analysis of that company's financial standing, walking you through all the steps of developing a sophisticated financial model as done by professional Wall Street analysts. You will construct a full scale financial model and valuation step-by-step as you page through the book.When we ran this analysis in January of 2012, we estimated the stock was undervalued. Since the first run of the analysis, the stock has increased 35 percent. Re-evaluating Wal-Mart 9months later, we will step through the techniques utilized by Wall Street analysts to build models on and properly value business entities.Step-by-step financial modeling - taught using downloadable Wall Street models, you will construct the model step by step as you page through the book.Hot keys and explicit Excel instructions aid even the novice excel modeler.Model built complete with Income Statement, Cash Flow Statement, Balance Sheet, Balance Sheet Balancing Techniques, Depreciation Schedule (complete with accelerating depreciation and deferring taxes), working capital schedule, debt schedule, handling circular references, and automatic debt pay downs.Illustrative concepts including detailing model flows help aid in conceptual understanding.Concepts are reiterated and honed, perfect for a novice yet detailed enough for a professional.Model built direct from Wal-Mart public filings, searching through notes, performing research, and illustrating techniques to formulate projections.Includes in-depth coverage of valuation techniques commonly used by Wall Street professionals.Illustrative comparable company analyses - built the right way, direct from historical financials, calculating LTM (Last Twelve Month) data, calendarization, and properly smoothing EBITDA and Net Income.Precedent transactions analysis - detailing how to extract proper metrics from relevant proxy statementsDiscounted cash flow analysis - simplifying and illustrating how a DCF is utilized, how unlevered free cash flow is derived, and the meaning of weighted average cost of capital (WACC)Step-by-step we will come up with a valuation on Wal-MartChapter end questions, practice models, additional case studies and common interview questions (found in the companion website) help solidify the techniques honed in the book; ideal for universities or business students looking to break into the investment banking field.

Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private Equity (Wiley Finance)

by Paul PignataroThe fully revised new edition of the best-selling guide to using financial models to determine if a stock is over or undervalued Written by the founder and CEO of the world-renowned New York School of Finance, Financial Modeling and Valuation provides clear and systematic guidance on accurately evaluating the soundness of a stock investment. This invaluable handbook equips investors with the tools necessary for understanding the underlying fundamentals of a rational investment and for making smarter investment decisions in any market environment. Built around an in-depth case study of global retail leader Amazon, this fully updated Second Edition shows you how to analyze the financial standing of a company using the methods of Wall Street professionals. Step-by-step, you will learn to build the core three statements—income statement, cash flow statement, and balance sheet—as well as the three major supporting schedules required for complete company valuation and analysis. All line items are explained in clear language and include real-world tips and techniques for using them as tools for valuing and managing a business. This must-have guide: Features new and in-depth case studies based on Amazon that simulate real-world modelling and valuation Explains valuation techniques such as illustrative comparable company analysis, precedent transactions analysis, and discounted cash flow analysis Covers all essential applications of a model, including pricing a stock, raising debt, and raising equity Includes an introductory section describing the recent and dramatic shift of the entire retail industry Provides end-of-chapter questions, downloadable practice models, additional case studies, and common interview questions via a companion website Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private Equity, Second Edition is essential reading for finance professionals, venture capitalists, individual investors, and students in investment banking and related degree programs in finance.

Financial Modeling for Business Owners and Entrepreneurs

by Tom Y. SawyerFinancial Modeling for Business Owners and Entrepreneurs: Developing Excel Models to Raise Capital, Increase Cash Flow, Improve Operations, Plan Projects, and Make Decisions may be one of the most important books any entrepreneur or manager in a small or medium-sized enterprise will read. It combines logical business principles and strategies with a step-by-step methodology for planning and modeling a company and solving specific business problems. You'll learn to create operational and financial models in Excel that describe the workings of your company in quantitative terms and that make it far more likely you will avoid the traps and dead ends many businesses fall into. Serial entrepreneur and financial expert Tom Y. Sawyer shows how to break your company down into basic functional and operational components that can be modeled. The result is a financial model that, for example, you can literally take to the bank or bring to local angel investors to receive the funding you need to launch your business or a new product. Or it might be a model that shows with startling clarity that your new product development effort is a likely winner--or loser. Even better, you'll learn to create models that will serve as guideposts for ongoing operations. You'll always know just where you are financially, and where you need to be. The models you will learn to build in Financial Modeling for Business Owners and Entrepreneurs can be used to: Raise capital for startup or any stage of growthPlan projects and new initiativesMake astute business decisions, including go/no-go assessmentsAnalyze ROI on your product development and marketing expendituresStreamline operations, manage budgets, improve efficiency, and reduce costsValue the business when it is time to cash out or mergeIn addition to many valuable exercises and tips for using Excel to model your business, this book contains a combination of practical advice born of hard-won lessons, advanced strategic thought, and the insightful use of hard skills. With a basic knowledge of Excel assumed, it will help you learn to think like an experienced business person who expects to make money on the products or services offered to the public. You'll discover that the financial model is a key management tool that, if built correctly, provides invaluable assistance every step of the entrepreneurial journey. Tom Y. Sawyer has used the principles this book contains to create financial models of numerous startup and early-stage companies, assisting them in planning for and raising the capital that they needed to grow their businesses and ultimately exit with multiples of their initial investment. Financial Modeling for Business Owners and Entrepreneurs, a mini-MBA in entrepreneurship and finance, will show you how you can do the same. Note: This book is an updated version of Sawyer's 2009 title, Pro Excel Financial Modeling.

Financial Modeling in Excel For Dummies

by Danielle Stein FairhurstMake informed business decisions with the beginner's guide to financial modeling using Microsoft Excel Financial Modeling in Excel For Dummies is your comprehensive guide to learning how to create informative, enlightening financial models today. Not a math whiz or an Excel power-user? No problem! All you need is a basic understanding of Excel to start building simple models with practical hands-on exercises. Before you know it, you’ll be modeling your way to optimized profits for your business in no time. Excel is powerful, user-friendly, and is most likely already installed on your computer—which is why it has so readily become the most popular financial modeling software. This book shows you how to harness Excel's capabilities to determine profitability, develop budgetary projections, model depreciation, project costs, value assets, and more. You'll learn the fundamental best practices and know-how of financial modeling, and how to put them to work for your business and your clients. You'll learn the tools and techniques that bring insight out of the numbers and make better business decisions based on quantitative evidence. You'll discover that financial modeling is an invaluable resource for your business, and you'll wonder why you've waited this long to learn how! Companies around the world use financial modeling for decision making, to steer strategy, and to develop solutions. This book walks you through the process with clear, expert guidance that assumes little prior knowledge. Learn the six crucial rules to follow when building a successful financial model Discover how to review and edit an inherited financial model and align it with your business and financial strategy Solve client problems, identify market projections, and develop business strategies based on scenario analysis Create valuable customized templates models that can become a source of competitive advantage From multinational corporations to the mom-and-pop corner store, there isn't a business around that wouldn't benefit from financial modeling. No need to buy expensive specialized software—the tools you need are right there in Excel. Financial Modeling in Excel For Dummies gets you up to speed quickly so you can start reaping the benefits today!

Financial Modeling in Excel For Dummies

by Danielle Stein FairhurstTurn your financial data into insightful decisions with this straightforward guide to financial modeling with Excel Interested in learning how to build practical financial models and forecasts but concerned that you don’t have the math skills or technical know-how? We’ve got you covered! Financial decision-making has never been easier than with Financial Modeling in Excel For Dummies. Whether you work at a mom-and-pop retail store or a multinational corporation, you can learn how to build budgets, project your profits into the future, model capital depreciation, value your assets, and more. You’ll learn by doing as this book walks you through practical, hands-on exercises to help you build powerful models using just a regular version of Excel, which you’ve probably already got on your PC. You’ll also: Master the tools and strategies that help you draw insights from numbers and data you’ve already got Build a successful financial model from scratch, or work with and modify an existing one to your liking Create new and unexpected business strategies with the ideas and conclusions you generate with scenario analysis Don’t go buying specialized software or hiring that expensive consultant when you don’t need either one. If you’ve got this book and a working version of Microsoft Excel, you’ve got all the tools you need to build sophisticated and useful financial models in no time!

Financial Modeling with Crystal Ball and Excel

by John CharnesPraise forFinancial Modeling with Crystal Ball(r) and Excel(r)"Professor Charnes's book drives clarity into applied Monte Carlo analysis using examples and tools relevant to real-world finance. The book will prove useful for analysts of all levels and as a supplement to academic courses in multiple disciplines."-Mark Odermann, Senior Financial Analyst, Microsoft"Think you really know financial modeling? This is a must-have for power Excel users. Professor Charnes shows how to make more realistic models that result in fewer surprises. Every analyst needs this credibility booster."-James Franklin, CEO, Decisioneering, Inc."This book packs a first-year MBA's worth of financial and business modeling education into a few dozen easy-to-understand examples. Crystal Ball software does the housekeeping, so readers can concentrate on the business decision. A careful reader who works the examples on a computer will master the best general-purpose technology available for working with uncertainty."-Aaron Brown, Executive Director, Morgan Stanley, author of The Poker Face of Wall Street"Using Crystal Ball and Excel, John Charnes takes you step by step, demonstrating a conceptual framework that turns static Excel data and financial models into true risk models. I am astonished by the clarity of the text and the hands-on, step-by-step examples using Crystal Ball and Excel; Professor Charnes is a masterful teacher, and this is an absolute gem of a book for the new generation of analyst."-Brian Watt, Chief Operating Officer, GECC, Inc."Financial Modeling with Crystal Ball and Excel is a comprehensive, well-written guide to one of the most useful analysis tools available to professional risk managers and quantitative analysts. This is a must-have book for anyone using Crystal Ball, and anyone wanting an overview of basic risk management concepts."-Paul Dietz, Manager, Quantitative Analysis, Westar Energy"John Charnes presents an insightful exploration of techniques for analysis and understanding of risk and uncertainty in business cases. By application of real options theory and Monte Carlo simulation to planning, doors are opened to analysis of what used to be impossible, such as modeling the value today of future project choices."-Bruce Wallace, Nortel

Financial Modeling with Crystal Ball and Excel (Wiley Finance #341)

by John CharnesPraise for Financial Modeling with Crystal Ball(r) and Excel(r) "Professor Charnes's book drives clarity into applied Monte Carlo analysis using examples and tools relevant to real-world finance. The book will prove useful for analysts of all levels and as a supplement to academic courses in multiple disciplines." -Mark Odermann, Senior Financial Analyst, Microsoft "Think you really know financial modeling? This is a must-have for power Excel users. Professor Charnes shows how to make more realistic models that result in fewer surprises. Every analyst needs this credibility booster." -James Franklin, CEO, Decisioneering, Inc. "This book packs a first-year MBA's worth of financial and business modeling education into a few dozen easy-to-understand examples. Crystal Ball software does the housekeeping, so readers can concentrate on the business decision. A careful reader who works the examples on a computer will master the best general-purpose technology available for working with uncertainty." -Aaron Brown, Executive Director, Morgan Stanley, author of The Poker Face of Wall Street "Using Crystal Ball and Excel, John Charnes takes you step by step, demonstrating a conceptual framework that turns static Excel data and financial models into true risk models. I am astonished by the clarity of the text and the hands-on, step-by-step examples using Crystal Ball and Excel; Professor Charnes is a masterful teacher, and this is an absolute gem of a book for the new generation of analyst." -Brian Watt, Chief Operating Officer, GECC, Inc. "Financial Modeling with Crystal Ball and Excel is a comprehensive, well-written guide to one of the most useful analysis tools available to professional risk managers and quantitative analysts. This is a must-have book for anyone using Crystal Ball, and anyone wanting an overview of basic risk management concepts." -Paul Dietz, Manager, Quantitative Analysis, Westar Energy "John Charnes presents an insightful exploration of techniques for analysis and understanding of risk and uncertainty in business cases. By application of real options theory and Monte Carlo simulation to planning, doors are opened to analysis of what used to be impossible, such as modeling the value today of future project choices." -Bruce Wallace, Nortel

Financial Modeling, Actuarial Valuation and Solvency in Insurance

by Mario V. Wüthrich Michael MerzRisk management for financial institutions is one of the key topics the financial industry has to deal with. The present volume is a mathematically rigorous text on solvency modeling. Currently, there are many new developments in this area in the financial and insurance industry (Basel III and Solvency II), but none of these developments provides a fully consistent and comprehensive framework for the analysis of solvency questions. Merz and Wüthrich combine ideas from financial mathematics (no-arbitrage theory, equivalent martingale measure), actuarial sciences (insurance claims modeling, cash flow valuation) and economic theory (risk aversion, probability distortion) to provide a fully consistent framework. Within this framework they then study solvency questions in incomplete markets, analyze hedging risks, and study asset-and-liability management questions, as well as issues like the limited liability options, dividend to shareholder questions, the role of re-insurance, etc. This work embeds the solvency discussion (and long-term liabilities) into a scientific framework and is intended for researchers as well as practitioners in the financial and actuarial industry, especially those in charge of internal risk management systems. Readers should have a good background in probability theory and statistics, and should be familiar with popular distributions, stochastic processes, martingales, etc.

Financial Modeling, fifth edition

by Simon Benninga Tal MofkadiA substantially updated new edition of the essential text on financial modeling, with revised material, new data, and implementations shown in Excel, R, and Python.Financial Modeling has become the gold-standard text in its field, an essential guide for students, researchers, and practitioners that provides the computational tools needed for modeling finance fundamentals. This fifth edition has been substantially updated but maintains the straightforward, hands-on approach, with an optimal mix of explanation and implementation, that made the previous editions so popular. Using detailed Excel spreadsheets, it explains basic and advanced models in the areas of corporate finance, portfolio management, options, and bonds. This new edition offers revised material on valuation, second-order and third-order Greeks for options, value at risk (VaR), Monte Carlo methods, and implementation in R. The examples and implementation use up-to-date and relevant data. Parts I to V cover corporate finance topics, bond and yield curve models, portfolio theory, options and derivatives, and Monte Carlo methods and their implementation in finance. Parts VI and VII treat technical topics, with part VI covering Excel and R issues and part VII (now on the book&’s auxiliary website) covering Excel&’s programming language, Visual Basic for Applications (VBA), and Python implementations. Knowledge of technical chapters on VBA and R is not necessary for understanding the material in the first five parts. The book is suitable for use in advanced finance classes that emphasize the need to combine modeling skills with a deeper knowledge of the underlying financial models.

Financial Modeling, fourth edition (The\mit Press Ser.)

by Simon BenningaA substantially revised edition of a bestselling text combining explanation and implementation using Excel; for classroom use or as a reference for finance practitioners. Financial Modeling is now the standard text for explaining the implementation of financial models in Excel. This long-awaited fourth edition maintains the “cookbook” features and Excel dependence that have made the previous editions so popular. As in previous editions, basic and advanced models in the areas of corporate finance, portfolio management, options, and bonds are explained with detailed Excel spreadsheets. Sections on technical aspects of Excel and on the use of Visual Basic for Applications (VBA) round out the book to make Financial Modeling a complete guide for the financial modeler.The new edition of Financial Modeling includes a number of innovations. A new section explains the principles of Monte Carlo methods and their application to portfolio management and exotic option valuation. A new chapter discusses term structure modeling, with special emphasis on the Nelson-Siegel model. The discussion of corporate valuation using pro forma models has been rounded out with the introduction of a new, simple model for corporate valuation based on accounting data and a minimal number of valuation parameters.New print copies of this book include a card affixed to the inside back cover with a unique access code. Access codes are required to download Excel worksheets and solutions to end-of-chapter exercises. If you have a used copy of this book, you may purchase a digitally-delivered access code separately via the Supplemental Material link on this page. If you purchased an e-book, you may obtain a unique access code by emailing digitalproducts-cs@mit.edu or calling 617-253-2889 or 800-207-8354 (toll-free in the U.S. and Canada).Praise for earlier editions“Financial Modeling belongs on the desk of every finance professional. Its no-nonsense, hands-on approach makes it an indispensable tool.”—Hal R. Varian, Dean, School of Information Management and Systems, University of California, Berkeley“Financial Modeling is highly recommended to readers who are interested in an introduction to basic, traditional approaches to financial modeling and analysis, as well as to those who want to learn more about applying spreadsheet software to financial analysis."—Edward Weiss, Journal of Computational Intelligence in Finance“Benninga has a clear writing style and uses numerous illustrations, which make this book one of the best texts on using Excel for finance that I've seen.”—Ed McCarthy, Ticker Magazine

Financial Modelling and Asset Valuation with Excel

by Morten Helbæk Ragnar Løvaas Jon Olav MjølhusFinance is Excel! This book takes you straight into the fascinating world of Excel, the powerful tool for number crunching. In a clear cut language it amalgamates financial theory with Excel providing you with the skills you need to build financial models for private or professional use. A comprehensive knowledge of modeling in Excel is becoming increasingly important in a competitive labour market. The chapters in part one start with the most basic Excel topics such as cell addresses, workbooks, basic formulas, etc. These chapters get more advanced through part one, and takes you in the end to topics such as array formulas, data tables, pivot tables, etc. The other parts of the book discusses a variety of subjects such as net present value, internal rate of return, risk, portfolio theory, CAPM, VaR, project valuation, asset valuation, firm valuation, loan, leasing, stocks, bonds, options, simulation, sensitivity analysis, etc.

Financial Modelling in Commodity Markets (Chapman and Hall/CRC Financial Mathematics Series)

by Viviana FanelliFinancial Modelling in Commodity Markets provides a basic and self-contained introduction to the ideas underpinning financial modelling of products in commodity markets. The book offers a concise and operational vision of the main models used to represent, assess and simulate real assets and financial positions related to the commodity markets. It discusses statistical and mathematical tools important for estimating, implementing and calibrating quantitative models used for pricing and trading commodity-linked products and for managing basic and complex portfolio risks. Key features: Provides a step-by-step guide to the construction of pricing models, and for the applications of such models for the analysis of real data Written for scholars from a wide range of scientific fields, including economics and finance, mathematics, engineering and statistics, as well as for practitioners Illustrates some important pricing models using real data sets that will be commonly used in financial markets

Financial Modelling in Practice

by Michael ReesFinancial Modelling in Practice: A Concise Guide for Intermediate and Advanced Level is a practical, comprehensive and in-depth guide to financial modelling designed to cover the modelling issues that are relevant to facilitate the construction of robust and readily understandable models.Based on the authors extensive experience of building models in business and finance, and of training others how to do so this book starts with a review of Excel functions that are generally most relevant for building intermediate and advanced level models (such as Lookup functions, database and statistical functions and so on). It then discusses the principles involved in designing, structuring and building relevant, accurate and readily understandable models (including the use of sensitivity analysis techniques) before covering key application areas, such as the modelling of financial statements, of cash flow valuation, risk analysis, options and real options. Finally, the topic of financial modelling using VBA is treated. Practical examples are used throughout and model examples are included in the attached CD-ROM.Aimed at intermediate and advanced level modellers in Excel who wish to extend and consolidate their knowledge, this book is focused, practical, and application-driven, facilitating knowledge to build or audit a much wider range of financial models.Note: CD-ROM/DVD and other supplementary materials are not included as part of eBook file.

Financial Modelling with Jump Processes (Chapman and Hall/CRC Financial Mathematics Series)

by Rama Cont Peter TankovWINNER of a Riskbook.com Best of 2004 Book Award!During the last decade, financial models based on jump processes have acquired increasing popularity in risk management and option pricing. Much has been published on the subject, but the technical nature of most papers makes them difficult for nonspecialists to understand, and the mathematic

Financial Modelling: Theory, Implementation and Practice with MATLAB Source (The Wiley Finance Series)

by Daniel Wetterau Joerg KienitzFinancial Modelling - Theory, Implementation and Practice is a unique combination of quantitative techniques, the application to financial problems and programming using Matlab. The book enables the reader to model, design and implement a wide range of financial models for derivatives pricing and asset allocation, providing practitioners with complete financial modelling workflow, from model choice, deriving prices and Greeks using (semi-) analytic and simulation techniques, and calibration even for exotic options.The book is split into three parts. The first part considers financial markets in general and looks at the complex models needed to handle observed structures, reviewing models based on diffusions including stochastic-local volatility models and (pure) jump processes. It shows the possible risk neutral densities, implied volatility surfaces, option pricing and typical paths for a variety of models including SABR, Heston, Bates, Bates-Hull-White, Displaced-Heston, or stochastic volatility versions of Variance Gamma, respectively Normal Inverse Gaussian models and finally, multi-dimensional models. The stochastic-local-volatility Libor market model with time-dependent parameters is considered and as an application how to price and risk-manage CMS spread products is demonstrated.The second part of the book deals with numerical methods which enables the reader to use the models of the first part for pricing and risk management, covering methods based on direct integration and Fourier transforms, and detailing the implementation of the COS, CONV, Carr-Madan method or Fourier-Space-Time Stepping. This is applied to pricing of European, Bermudan and exotic options as well as the calculation of the Greeks. The Monte Carlo simulation technique is outlined and bridge sampling is discussed in a Gaussian setting and for Lévy processes. Computation of Greeks is covered using likelihood ratio methods and adjoint techniques. A chapter on state-of-the-art optimization algorithms rounds up the toolkit for applying advanced mathematical models to financial problems and the last chapter in this section of the book also serves as an introduction to model risk. The third part is devoted to the usage of Matlab, introducing the software package by describing the basic functions applied for financial engineering. The programming is approached from an object-oriented perspective with examples to propose a framework for calibration, hedging and the adjoint method for calculating Greeks in a Libor Market model.Source code used for producing the results and analysing the models is provided on the author's dedicated website, http://www.mathworks.de/matlabcentral/fileexchange/authors/246981

Financial Models and Tools for Managing Lean Manufacturing (Supply Chain Integration Modeling, Optimization and Application)

by David MeadeThe effect Lean Manufacturing programs have on profit and loss statements during the early months of their implementation often causes them to be viewed as failures. The length of time it will take traditional financial reports to reflect lean manufacturing improvements depends upon how poorly the operation was doing in terms of inventory managemen

Financial Models in Production (SpringerBriefs in Finance)

by Adil Reghai Othmane KettaniThis book provides a hands-on guide to how financial models are actually implemented and used in practice, on a daily basis, for pricing and risk-management purposes. It shows how to put these models into use in production while minimizing the cost of implementation and maximizing robustness and control. Addressing some of the most important and cutting-edge issues, it describes how to build the necessary models in order to risk manage all the costs involved in options fabrication within the world of equity derivatives and hybrids. This is achieved by extending classical models and improving them in order to account for complex features. The book is primarily aimed at market practitioners (traders, risk managers, risk control, top managers), as well as Masters students in Quantitative/Mathematical Finance. It will also be useful for instructors hoping to enrich their courses with practical examples. The prerequisites are basic stochastic calculus and a general knowledge of financial markets and financial derivatives.

Financial Models with Levy Processes and Volatility Clustering

by Svetlozar T. Rachev Frank J. Fabozzi Michele L. Bianchi Young Shin KimAn in-depth guide to understanding probability distributions and financial modeling for the purposes of investment managementIn Financial Models with Lévy Processes and Volatility Clustering, the expert author team provides a framework to model the behavior of stock returns in both a univariate and a multivariate setting, providing you with practical applications to option pricing and portfolio management. They also explain the reasons for working with non-normal distribution in financial modeling and the best methodologies for employing it.The book's framework includes the basics of probability distributions and explains the alpha-stable distribution and the tempered stable distribution. The authors also explore discrete time option pricing models, beginning with the classical normal model with volatility clustering to more recent models that consider both volatility clustering and heavy tails.Reviews the basics of probability distributionsAnalyzes a continuous time option pricing model (the so-called exponential Lévy model)Defines a discrete time model with volatility clustering and how to price options using Monte Carlo methodsStudies two multivariate settings that are suitable to explain joint extreme eventsFinancial Models with Lévy Processes and Volatility Clustering is a thorough guide to classical probability distribution methods and brand new methodologies for financial modeling.

Financial Organization and Operations of the IMF

by International Monetary FundA report from the International Monetary Fund.

Financial Origami

by Brendan MoynihanAn in-depth look at the failure of Wall Street's "proven" financial models Origami is the Japanese art of folding paper into intricate and aesthetically attractive shapes. As such, it is the perfect metaphor for the Wall Street financial engineering model, which ultimately proved to be the underlying cause of the 2008 financial crisis. In Financial Origami, Brendan Moynihan describes how the Wall Street business model evolved from a method to transfer risk into a method for manufacturing risk. Along the way, this timely book skillfully dissects financial engineering and addresses how it's often a mechanism to evade regulatory constraints, provide institutional investors with customized products, and, of course, generate revenue for financial engineers. Reveals how Wall Street's financial engineering business model morphed into something destructive Highlights how the origami model worked well in the comparatively stable years of the early 2000s, when there was less risk to transfer Discusses how Wall Street began manufacturing risk by creating products that multiplied risk exposures and encouraged subprime lending With the collapse of Lehman Brother the Wall Street business model effectively broke. But there are many lessons to be learned from what has transpired, and Financial Origami will show you what they are.

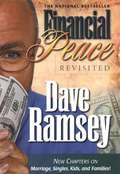

Financial Peace Revisited

by Dave RamseyDave Ramsey knows what it's like to have it all. By age twenty-six, he had established a four-million-dollar real estate portfolio, only to lose it by age thirty. He has since rebuilt his financial life and, through his workshops and his New York Times business bestsellers Financial Peace and More than Enough, he has helped hundreds of thousands of people to understand the forces behind their financial distress and how to set things right--financially, emotionally, and spiritually. In this new edition of Financial Peace, Ramsey has updated his tactics and philosophy to show even more readers: how to get out of debt and stay out, the KISS rule of investing--"Keep It Simple, Stupid" how to use the principle of contentment to guide financial decision making how the flow of money can revolutionize relationships. With practical and easy to follow methods and personal anecdotes, Financial Peace is the road map to personal control, financial security, a new, vital family dynamic, and lifetime peace.

Financial Peace Revisited: New Chapters on Marriage, Singles, Kids and Families

by Dave RamseyDave Ramsey knows what it's like to have it all. By age twenty-six, he had established a four-million-dollar real estate portfolio, only to lose it by age thirty. He has since rebuilt his financial life and, through his workshops and his New York Times business bestsellers Financial Peace and More than Enough, he has helped hundreds of thousands of people to understand the forces behind their financial distress and how to set things right-financially, emotionally, and spiritually.In this new edition of Financial Peace, Ramsey has updated his tactics and philosophy to show even more readers:how to get out of debt and stay outthe KISS rule of investing--"Keep It Simple, Stupid"how to use the principle of contentment to guide financial decision makinghow the flow of money can revolutionize relationshipsWith practical and easy to follow methods and personal anecdotes, Financial Peace is the road map to personal control, financial security, a new, vital family dynamic, and lifetime peace.

Financial Performance Measures and Value Creation: the State of the Art

by Daniela VenanziThe choice of financial performance measures is one of the most critical challenges facing organizations. The accounting-based measures of financial performance have been viewed as inadequate, as firms began focusing on shareholder value as the primary long-term objective of the organization. Hence, value-based metrics were devised that explicitly incorporate the cost of capital into performance calculations. Despite the increasing emphasis on these value-based measures, no definitive evidence exists of which metric works better than others, and on the extent to which any of them is superior to traditional accounting measures. In this scenario, the objective of this book is contributing to the ongoing dialogue on the appropriateness of different financial performance measures, by providing a systematic and updated review of the major value-based measures, by highlighting their respective strengths and weaknesses and by comparing the main international empirical evidence on their effectiveness. This book can be a powerful tool for guiding managers and graduate students in the "tangled forest" of the existing metrics, by providing them with the quick, but adequate knowledge for consistently adopting them.

Financial Perspective

by Robert S. Kaplan David P. NortonFinancial objectives represent the long-term goal of the organization: to provide superior returns based on the capital invested in the unit. Building a Balanced Scorecard should encourage business units to link their financial objectives to corporate strategy. This chapter looks at the dual role financial objectives and measures must play, defining the financial performance expected from the strategy, and serving as the ultimate targets for the objectives and measures of all the other scorecard perspectives. This chapter was originally published as chapter 3 of "The Balanced Scorecard: Translating Strategy into Action."