- Table View

- List View

Investor Relations Practices at Edwards Lifesciences

by C. Fritz Foley F. Katelynn BolandIn January 2017, the senior leadership team at Edwards Lifesciences were preparing for the quarterly earnings call that would cover the fourth quarter of 2016. They faced questions about what types of information they should disclose on the call, as well as during other key investor relation events that take place throughout the year. <p><p> This case gives students an opportunity to study investor relations decisions, what considerations take place in disclosing various information, and how investor events should be structured and managed.

Investor Relations and ESG Reporting in a Regulatory Perspective: A Practical Guide for Financial Market Participants

by Poul Lykkesfeldt Laurits Louis KjaergaardInvestor Relations and ESG Reporting in a Regulatory Perspective is a comprehensive and detailed practical guide for financial market participants, focusing on the stock market, written for practitioners by practitioners. The main themes of the book include the challenging integration of investor relations (IR) and the non-financial reporting of environmental, social and governance (ESG). Further, the book provides a comprehensive overview of the complex regulatory framework of the European Union (EU) related to the financial markets, including the expected global trends in this area. This includes financial legislation such as MiFID II, MiFIR and MAR along with non-financial legislation like the EU’s taxonomy, CSRD and SFDR. In addition, this book explores the non-financial reporting standards of GRI, TCFD, CDSB, IBC, SASB, IRRC and the upcoming ISSB, and discusses the UN’s Sustainable Development Goals (SDGs). In addition, the book provides a practical guide regarding IR in special situations, e.g. in connection with takeover response manuals, M&A, investor activism, initial public offerings (IPOs), as well companies’ collaboration with e.g. investment banks and corporate finance advisers, financial PR and IR advisers in such situations. The suggested audience of the book includes board members and senior management of in particular listed companies, and companies considering an IPO; professionals working in the fields of IR, ESG and communications; institutional and retail investors; private equity executives; venture capitalists; investment bankers; legal practitioners; accountants and auditors; financial journalists; and politicians. Finally, university and business students may benefit from an insight into the dynamics of the financial markets and the direction they are moving, a possible inspiration for choosing a future career.

Investor Relations and Financial Communication: Creating Value Through Trust and Understanding (Handbooks In Communication And Media Ser.)

by Alexander V. LaskinEquips students and professionals with the fundamental skills and knowledge needed to succeed in investor relations and financial communication Investor Relations and Financial Communication is a comprehensive, up-to-date introduction to the investor relations and financial communication profession. Written by a leading educator and professional consultant, this authoritative textbook provides the well-rounded foundation necessary for anyone wanting to begin a career as an Investor Relations Officer (IRO). Detailed yet accessible chapters describe all essential aspects of the field, including communication skills, basic financial knowledge, legal and regulatory guidelines, professional standards and practices, and more. Organized in five sections, the book first identifies and defines the jobs available in investor relations and financial communication, detailing the responsibilities, titles, salaries, and key players in the industry. After thoroughly explaining the disclosure of financial and non-financial information, the author describes the regulatory environment in which professionals operate and offers expert insight into issues of corporate governance, environmental sustainability, social responsibility, shareholder activism, and crisis management. Subsequent sections highlight the day-to-day activities of investor relations and financial communication professionals and discuss the future of the field. This invaluable textbook also: Describes the responsibilities of the Investor Relations Officer throughout initial public offering, periodic reporting, and performance evaluation Discusses the role of investor relations professionals in disclosing financial information and educating the investment community Emphasizes the various skills that IROs must possess in order to do their jobs successfully, such as marketing and securities law compliance Includes end-of-chapter review questions, activities, and lists of key terms Investor Relations and Financial Communication: Creating Value Through Trust and Understanding is the perfect textbook for both professional development training programs and undergraduate and graduate courses in investor relations, and is required reading for all those working in investor relations, particularly early-career professionals.

Investor Relations at TOTAL

by Gregory S. Miller Vincent Dessain Anders SjomanExamines investor relations and financial communications in a large company with a diverse group of financial stakeholders. Total is an "energy major" based in Paris, France. The importance of its product and its impact on economies and environments combine with the size of the company to make Total highly visible to investors, governments, environmental groups, and other shareholders. The highly technical nature of Total's many internal activities and the breadth of its complex operations further impacts communication efforts. In addition, as a Continental European firm (in particular, French), Total has strong societal expectations regarding its interactions with employees/citizens vs. shareholders. Examines how Total creates a consistent and clear financial communication that provides information to these diverse stakeholder bases and their different desires for the company. Also asks students to consider how this communication strategy will need adjustment due to a period of high oil prices and a resulting windfall profit during 2005.

Investor Relations: Neue empirische Studien zur Kapitalmarktkommunikation

by Manfred Piwinger Markus KieferDer vorliegende Band enthält drei sich einander ergänzende Studien zur Praxis der Kapitalmarktkommunikation (Investor Relations). Neben einem knapp gefassten Überblick über das Berufsfeld selbst wird die Qualität der finanziellen Berichterstattung dargestellt und danach auf das bisher noch in der Entwicklung steckende Feld der Ermittlung und Messung nichtfinanzieller Leistungsindikatoren eingegangen; im Weiteren, wie Unternehmen ihre Position am Kapitalmarkt darstellen sowie welche Ziele sich die Kapitalmarktkommunikation selbst setzt. Die von den Autoren über die Jahre hinweg zusammengetragenen Zitate aus den jährlichen Geschäfts- und Nachhaltigkeitsberichten spiegelt die Sicht der jeweiligen Unternehmen wider. Sie haben teilweise auffällige Gemeinsamkeiten, differieren jedoch abhängig von Branche, Markstellung und Aktionärsstruktur.

Investor Results: Building Shareholder Value

by Dave Ulrich Norm Smallwood Jack ZengerResults-based leaders must demonstrate an ability to make decisions and act in ways that build investor confidence. This chapter offers suggestions to leaders in publicly traded firms for increasing shareholder value.

Investor Stewardship and the UK Stewardship Code: The Role of Institutional Investors in Corporate Governance

by Robert Goddard Daniel CashThis book provides a critical assessment of the development of the Stewardship Code 2020, which sets out principles regarding the role of institutional investors in corporate governance. It discusses how the regulatory framework for stewardship evolved before and after the financial crisis, and how that evolution resulted in the 2020 Code. It then critiques the Code from a practical and academic perspective, as well as evaluating the wider regulatory framework; in particular, the position of the FRC (ARGA). The book concludes by offering insight into different pathways that the evolution of stewardship may continue to take. Stewardship Codes modelled on the U.K.’s original 2010 version have been introduced in numerous markets and as such the book will be relevant for an international audience of academics, regulators and policymakers in financial regulation, investment regulation and financial services.

Investor Therapy: A Psychologist and Investing Guru Tells You How to Out-Psych Wall Street

by Richard GeistIf your investing strategy has relied on the facts—financial statements, annual reports, technical charts, and so on—congratulations! You’re on the way to becoming a successful, complete investor. But you’re only partway there. If the markets are about mood swings, turbulence, and uncertainty, if the herd buys like crazy one day, only to sell off the next, doesn’t it make sense for you to have a grip on the way in which your individual psychological makeup and emotional state affect your investing strategy? Doesn’t the complete investor need to understand both the facts in his head and the emotions of his heart?Dr. Richard Geist has combined the art and science of the seemingly unrelated fields of psychology and investing. He shows that investing success means both having and using solid information and expertly understanding, monitoring, and managing your emotions. This is the first book directed at professional and individual investors alike, illustrating how they can use emotions to become more effective at meeting the ever-increasing challenges of today’s investing environment. Dr. Geist’s coverage is stimulating and wide-ranging, including topics such as:•Recognizing emotional reactions such as confidence and anxiety as clues to making investment decisions•Avoiding the most common psychological investment mistakes•Analyzing your psychological risk quotient•Reacting appropriately when you’re caught in a stampeding herd•Learning how patience—or the lack of it—influences investing decisions•Responding in psychologically healthy ways to losing money in the market•Gaining the psychological skills you need to sell a stock and learning why these skills differ from those needed when making a buy decision •Understanding the psychological needs of management while obtaining useful, valid information for making informed investing decisionsConventional wisdom says “park your emotions at the door when making investing decisions.” Dr. Geist brings a new, important perspective to show that the conventional wisdom is not only wrong but harmful to your financial well-being. Success lies in understanding your emotional reactions to the market and its participants and integrating an emotional understanding of yourself into your investing strategies. The successful investor is, above all, a human investor, not a “perfect” machine-like investor.

Investor's Guide to Loss Recovery

by Louis L. StraneyEssential guidance for recovery of lost assets through arbitration, mediation and other forms of conflict resolution Since the discovery of the Madoff fraud and investment scandals associated with the global credit crisis, investors have become aware that they can fight back and demand both justice and monetary recovery. To date, the only reliable resources on securities arbitration have been either sensationalized accounts of how to sue Wall Street or legal references, which provide no practical application. Filled with expert guidance showing investors how arbitration works, Investor's Guide to Loss Recovery fills that gap by providing a focus on all of the investor's options when a conflict arises. Includes charts showing the major areas of litigation as well as empirical evidence of enhanced awareness of investment misconduct Proprietary research by the author, demonstrating arbitration results Analysis on how newly enacted regulatory reforms will impact the process and options for financial fraud victims Personal interviews with securities attorneys, experts and investors Detailed scripts of initial attorney interviews, mediation and arbitration New financial regulations are impacting the options available to investors looking to recover assets. Investor's Guide to Loss Recovery is must-have reading for every investor, financial advisor, and attorney.

Investor's Passport to Hedge Fund Profits

by Sean D. Casterline Robert G. Yetman Jr.A comprehensive guide to international investingOpportunities to tap into foreign markets and, in turn, entirely new investment universes-that have traditionally been accessible only to hedge fund managers-are at hand, and this book offers you the straight story on how to look abroad for the next addition to your portfolio.Throughout these pages, the authors skillfully demonstrate how active, cutting-edge trading strategies used in domestic markets can be applied effectively overseas. Opening with discussions of the importance of international investing in today's turbulent markets, this reliable resource quickly moves on to examine the macro relationships between the different asset classes within a given country and shows you how to view those asset classes-stocks, bonds, currencies, and commodities-as a complete picture of what is happening in the investing world.Addresses the application of strategies to international portfolio development and managementClearly defines different financial markets and reveals how they can best be accessed and tradedFeatures information on currency trading and investing in foreign real estate as well as insights on swaps, futures trading, and risk managementThe Investor's Passport to Hedge Fund Profits demystifies international investing and gives you the tools by which to effectively profit from a wide array of asset classes.

Investor-State Dispute Settlement and National Courts: Current Framework and Reform Options (European Yearbook of International Economic Law)

by Gabrielle Kaufmann-Kohler Michele PotestàThis open access book examines the multiple intersections between national and international courts in the field of investment protection, and suggests possible modes for regulating future jurisdictional interactions between domestic courts and international tribunals. The current system of foreign investment protection consists of more than 3,000 international investment agreements (IIAs), most of which provide for investment arbitration as the forum for the resolution of disputes between foreign investors and host States. However, national courts also have jurisdiction over certain matters involving cross-border investments. International investment tribunals and national courts thus interact in a number of ways, which range from harmonious co-existence to reinforcing complementation, reciprocal supervision and, occasionally, competition and discord. The book maps this complex relationship between dispute settlement bodies in the current investment treaty context and assesses the potential role of domestic courts in future treaty frameworks that could emerge from the States’ current efforts to reform the system.The book concludes that, in certain areas of interaction between domestic courts and international investment tribunals, the “division of labor” between the two bodies is not always optimal, producing inefficiencies that burden the system as a whole. In these areas, there is a need for improvement by introducing a more fruitful allocation of tasks between domestic and international courts and tribunals – whatever form(s) the international mechanism for the settlement of investment disputes may take.Given its scope, the book contributes not only to legal analysis, but also to the policy reflections that are needed for ongoing efforts to reform investor-State dispute settlement.

Investors and Markets: Portfolio Choices, Asset Prices, and Investment Advice (Princeton Lectures in Finance #3)

by William F. SharpeIn Investors and Markets, Nobel Prize-winning financial economist William Sharpe shows that investment professionals cannot make good portfolio choices unless they understand the determinants of asset prices. But until now asset-price analysis has largely been inaccessible to everyone except PhDs in financial economics. In this book, Sharpe changes that by setting out his state-of-the-art approach to asset pricing in a nonmathematical form that will be comprehensible to a broad range of investment professionals, including investment advisors, money managers, and financial analysts. Bridging the gap between the best financial theory and investment practice, Investors and Markets will help investment professionals make better portfolio choices by being smarter about asset prices. Based on Sharpe's Princeton Lectures in Finance, Investors and Markets presents a method of analyzing asset prices that accounts for the real behavior of investors. Sharpe makes this technique accessible through a new, one-of-a-kind computer program (available for free on his Web site, at http://www.stanford.edu/~wfsharpe/apsim/index.html) that enables users to create virtual markets, setting the starting conditions and then allowing trading until equilibrium is reached and trading stops. Program users can then analyze the final portfolios and asset prices, see expected returns, and measure risk. In addition to popularizing the most sophisticated form of asset-price analysis, Investors and Markets summarizes much of Sharpe's most important previous work and reflects a lifetime of thinking about investing by one of the leading minds in financial economics. Any serious investment professional will benefit from Sharpe's unique insights.

Investors' Guide to the United Kingdom 2012/13

by Jonathan ReuvidThis new, fully updated fifth edition of Investors' Guide to the United Kingdom provides an authoritative and essential guide to the current investment climate in the United Kingdom. This includes the principal sectors of opportunity for foreign investors, the grants and incentives available, the financial sector and the laws and business regulations that affect foreign investors.In its World Investment Report 2012, the United Nations Conference on Trade and Development (UNCTAD) confirmed the UK as the largest recipient of foreign direct investment stock in Europe. The Ernst & Young European Attractiveness Survey 2010 found that the UK is the most attractive location for investment in Europe. This reflects its enterprise culture, business-friendly employment laws, world-class support services and relatively benign fiscal policies.Aimed at foreign businesses of all sizes, from multinationals to SMEs and private investors in the UK, this unique guide offers in-depth briefings on the technical aspects of investment as well as business start-up, covering topics such as:Grants and incentives Company formation Financial reporting Business taxation Banking and Finance Local Enterprise Partnerships Commercial law Intellectual property Immigration Pensions and benefits Mergers & acquisitions Joint ventures Private equity and venture capital, AIM market of the London Stock Exchange

Investors' Guide to the United Kingdom 2015/16

by Jonathan ReuvidThis new, fully updated 8th edition of Investors' Guide to the United Kingdom provides an authoritative and essential guide to the current investment climate in the United Kingdom. This includes the principal sectors of opportunity for foreign investors, the grants and incentives available, the financial sector and the laws and business regulations that affect foreign investors. In its World Investment Report 2013, the United Nations Conference on Trade and Development (UNCTAD) reconfirmed the UK as the largest recipient of foreign direct investment stock in Europe. The Ernst & Young European Attractiveness Survey 2014 found that the UK is the most attractive location for investors in Europe and ranks fifth globally after China, the US, India and Brazil in foreign investors' expectations over the next three years. This reflects its enterprise culture, businessfriendly employment laws, world-class support services and relatively benign fiscal policies. Aimed at foreign businesses of all sizes, from multinationals to SMEs as well as Sovereign Wealth Funds, this unique guide offers in-depth briefings on the technical aspects of investment as well as business start-up. This edition features investment opportunities in energy and regeneration which are of interest to primary asset fund managers as well as other key business sectors. Investors' Guide to the United Kingdom is published in association with UK Trade & Investment. Includes a Foreword from Michael Boyd, Managing Director Investment, UK Trade & Investment.

Investors’ Preferences in Financing New Ventures: A Data Mining Approach to Equity

by Caterina Lucarelli Francesco James MazzocchiniThis book aims at providing an empirical understanding of the main drivers affecting investors’ preferences in financing new ventures through equity crowdfunding (ECF) and determining fundraising campaign success. ECF is increasing in prominence as a route for new ventures in obtaining external financial resources. To raise capital, entrepreneurs are required to convey quality signals of their proposals with real-time information and knowledge sharing. This book advances knowledge in entrepreneurial finance by investigating the factors that affect individuals’ decisions to participate in ECF. The authors adopt a data mining approach to extract publicly available information from a multitude of crowdfunding platforms across different countries, producing a unique dataset. The book uses an innovative hybrid analysis to generate knowledge patterns creating data-driven models on one hand, and on the other test research hypotheses adopting statistical models to investigate empirical evidence in line, or in contrast, with the extant literature. The book also integrates organizational theories to examine the extent to which ECF platform managers follow a strategy of isomorphism in their choice of information disclosure. The final part of the book discusses how signals are interpreted by investors, how these affect financing preferences, and ultimately the successful completion of a fundraising campaign. The book will be of interest to academics and practitioners in entrepreneurial finance, FinTech, and investment behaviour.

Invierta en Acciones: Guía de Principiantes para dominar el mercado de valores

by Adidas WilsonInnumerables veces habrá escuchado que debería invertir. Sin embargo, invertir no es tan sencillo. Hay muchísimos aspectos a tener en cuenta—y eso sin mencionar los riesgos. El punto es que, llegado el momento de escoger cuál inversión hacer, hay un gran número de opciones. Además, cada persona con la que hable le va a recomendar una opción diferente, y esto puede ser desorientador. Primero que todo tenga esto en cuenta lo siguiente: lo que para otra persona puede realmente ser una buena inversión, no necesariamente será una buena inversión para usted. Ante todo establezca cuáles son sus objetivos, evalúe los activos con los que cuenta y luego prepare su presupuesto. Ahora busque qué inversiones podría hacer teniendo en cuenta su presupuesto y calcule cuál es su potencial de crecimiento. Definiendo sus objetivos: ¿Con qué tipo de inversiones quiere involucrarse? Pueden ser materias primas, divisas, acciones, fondos mutuos, bonos, bienes raíces y muchas más. Cualquiera de ellas podría hacerle ganar dinero, pero tiene que averiguar cuál de ellas lo hará. También debe definir la razón por la que está invirtiendo. ¿Es para la universidad de sus hijos, para comprar una casa, para dejarlo como herencia, para su jubilación?

Invigorating the Practice of Leadership: Aligning Organizational Needs with Individual Capabilities

by Robert J. ThomasThis chapter introduces an experience-based approach to leader development that can help organizations grow more leaders, over a larger terrain and faster than ever before.

Invirtiendo Para el Mañana: Descubra estrategias comprobadas para operar e invertir en cualquier tipo de mercado

by Sam Pierce¡Coloque su dinero tan duramente ganado en una inversión segura para el mañana ahora mismo! Hay inversores que se dedican a invertir a largo plazo. Su estrategia se conoce como "position trading". Este es un enfoque a largo plazo que busca participar en la retención de activos durante un período prolongado de tiempo. Si usted es paciente y no tiene prisa por obtener ganancias rápidas, puede considerar el position trading como una opción para usted. La posición es una progresión lógica del swing trading. La razón es que se necesita bastante previsión para determinar cual será la situación de una acción dentro de seis meses. Esto requiere mucha investigación y comprensión del mercado. Si no está familiarizado con la dinámica de un mercado determinado o de las empresas que lo componen, puede resultarle difícil "cronometrar" los movimientos de estos valores o activos. En este libro aprenderá reglas como: •La comprensión de los Fundamentos del Position Trading •La diferencia entre el Position Trading y el Swing/Day Trading •Razones para invertir a largo plazo •Ventajas y desventajas de la inversión a largo plazo •Acciones para mantener a largo plazo •Fundamentos del position trading •Uso del análisis técnico y del análisis fundamental en las operaciones de posición •Identificación de las tendencias a largo plazo •Ignorar las ganancias a corto plazo •Detección de rupturas a largo plazo •Creación de riqueza a través del position trading •Protección contra los cambios en el mercado •Diversificación contra el riesgo •Mantener una cartera equilibrada •Comprensión de los fundamentos del Swing Trading •La diferencia entre el Swing Trading y el Day Trading •El "análisis de la vela"

Invisible Barriers: Understanding and Overcoming Discrimination in the Workplace

by Stephane Carcillo Marie-Anne ValfortAn essential resource for anyone committed to fostering equality and fairness in employment—with actionable proposals for public policy that can address these inequities.In a world where discrimination against minorities remains a pressing issue even in economically and socially advanced countries, Invisible Barriers delves into the multifaceted nature of this pervasive problem. Drawing on extensive research from economics, management, psychology, and sociology, Stéphane Carcillo and Marie-Anne Valfort present a comprehensive examination of discriminatory practices in employment and their profound social and economic impacts.The first part of the book methodically explores the forms, sources, and consequences of discrimination in the labor market, offering readers a solid understanding of the approaches used to measure and identify discriminatory practices. In the second part, the book details research findings on specific groups, illustrating how discrimination manifests uniquely across different demographics: women, ethnic minorities, older workers, LGBTIQ+, and more. From recruitment biases to career advancement hurdles, the book sheds light on the varied and often hidden ways that discrimination operates. Finally, the authors discuss public policies aimed at mitigating discrimination, advocating for a multifaceted approach that combines punitive measures with incentives, educational programs, and communication campaigns to effectively combat biases, prejudices, and stereotypes.

Invisible Capital: How Unseen Forces Shape Entrepreneurial Opportunity

by Chris RabbWriter, consultant and speaker Chris Rabb coined the term "invisible capital" to represent the unseen forces that dramatically impact entrepreneurial viability when a good attitude, a great idea, and hard work simply aren't enough. In his book, Invisible Capital: How Unseen Forces Shape Entrepreneurial Opportunity, Rabb puts forth concrete and effective ways entrepreneurs and their advocates can build and grow sustainable enterprises amid these unseen forces created by society's unevenplaying field. By honoring democratic ideals, challenging assumptions, and reframing how success is defined, Rabb illuminates the promise of commonwealth entrepreneurship. This compelling and often counter-intuitive book illustrates how broad and meaningful entrepreneurial opportunity benefits not just individual entrepreneurs, but local communities and society at large.

Invisible Capital: How Unseen Forces Shape Entrepreneurial Opportunity

by Chris RabbWriter, consultant and speaker Chris Rabb coined the term "invisible capital" to represent the unseen forces that dramatically impact entrepreneurial viability when a good attitude, a great idea, and hard work simply aren't enough. In his book, Invisible Capital: How Unseen Forces Shape Entrepreneurial Opportunity, Rabb puts forth concrete and effective ways entrepreneurs and their advocates can build and grow sustainable enterprises amid these unseen forces created by society's uneven playing field. By honoring democratic ideals, challenging assumptions, and reframing how success is defined, Rabb illuminates the promise of commonwealth entrepreneurship. This compelling and often counter-intuitive book illustrates how broad and meaningful entrepreneurial opportunity benefits not just individual entrepreneurs, but local communities and society at large.

Invisible China: How the Urban-Rural Divide Threatens China’s Rise

by Scott Rozelle Natalie HellAs the glittering skyline in Shanghai seemingly attests, China has quickly transformed itself from a place of stark poverty into a modern, urban, technologically savvy economic powerhouse. But as Scott Rozelle and Natalie Hell show in Invisible China, the truth is much more complicated and might be a serious cause for concern. China’s growth has relied heavily on unskilled labor. Most of the workers who have fueled the country’s rise come from rural villages and have never been to high school. While this national growth strategy has been effective for three decades, the unskilled wage rate is finally rising, inducing companies inside China to automate at an unprecedented rate and triggering an exodus of companies seeking cheaper labor in other countries. Ten years ago, almost every product for sale in an American Walmart was made in China. Today, that is no longer the case. With the changing demand for labor, China seems to have no good back-up plan. For all of its investment in physical infrastructure, for decades China failed to invest enough in its people. Recent progress may come too late. Drawing on extensive surveys on the ground in China, Rozelle and Hell reveal that while China may be the second-largest economy in the world, its labor force has one of the lowest levels of education of any comparable country. Over half of China’s population—as well as a vast majority of its children—are from rural areas. Their low levels of basic education may leave many unable to find work in the formal workplace as China’s economy changes and manufacturing jobs move elsewhere. In Invisible China, Rozelle and Hell speak not only to an urgent humanitarian concern but also a potential economic crisis that could upend economies and foreign relations around the globe. If too many are left structurally unemployable, the implications both inside and outside of China could be serious. Understanding the situation in China today is essential if we are to avoid a potential crisis of international proportions. This book is an urgent and timely call to action that should be read by economists, policymakers, the business community, and general readers alike.

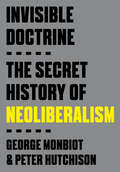

Invisible Doctrine: The Secret History of Neoliberalism

by George Monbiot Peter HutchisonWe live under an ideology that preys on every aspect of our lives: our education and our jobs; our healthcare and our leisure; our relationships and our mental well-being; the planet we inhabit—the very air we breathe. It is everywhere. Yet for most people, it has no name. It seems inescapable, like a natural law.But trace it back to its roots, and you see that this ideology is neither inevitable nor immutable. It was conceived and propagated—and then concealed—by the powerful few. Our task is to bring it into the light—and to build a new system that is worth fighting for. Neoliberalism.Do you know what it is?

Invisible Engines: How Software Platforms Drive Innovation and Transform Industries (The\mit Press Ser.)

by Richard Schmalensee David S. Evans Andrei HagiuHarnessing the power of software platforms: what executives and entrepreneurs must know about how to use this technology to transform industries and how to develop the strategies that will create value and drive profits.Software platforms are the invisible engines that have created, touched, or transformed nearly every major industry for the past quarter century. They power everything from mobile phones and automobile navigation systems to search engines and web portals. They have been the source of enormous value to consumers and helped some entrepreneurs build great fortunes. And they are likely to drive change that will dwarf the business and technology revolution we have seen to this point. Invisible Engines examines the business dynamics and strategies used by firms that recognize the transformative power unleashed by this new revolution—a revolution that will change both new and old industries.The authors argue that in order to understand the successes of software platforms, we must first understand their role as a technological meeting ground where application developers and end users converge. Apple, Microsoft, and Google, for example, charge developers little or nothing for using their platforms and make most of their money from end users; Sony PlayStation and other game consoles, by contrast, subsidize users and make more money from developers, who pay royalties for access to the code they need to write games. More applications attract more users, and more users attract more applications. And more applications and more users lead to more profits.Invisible Engines explores this story through the lens of the companies that have mastered this platform-balancing act. It offers detailed studies of the personal computer, video game console, personal digital assistant, smart mobile phone, and digital media software platform industries, focusing on the business decisions made by industry players to drive profits and stay a step ahead of the competition. Shorter discussions of Internet-based software platforms provide an important glimpse into a future in which the way we buy, pay, watch, listen, learn, and communicate will change forever. An electronic version of this book is available under a Creative Commons license.

Invisible Giants: Changing the World One Step at a Time

by Lindsay LevinInvisible Giants is about leadership, choices in life and the potential in everyone to make a difference. Lindsay Levin, who founded the social enterprise Leaders' Quest, tells the stories of the remarkable people she has met, and their impact on the world. They are individuals who have overcome a lack of education and resources to re-energise their communities, and business leaders who strive to integrate purpose alongside profit. They are female activists in slums campaigning to end the exclusion of girls from school, and environmentalists tackling the effects of industrialisation on the world's ecosystem. They are the people we meet every day, who are revisiting their life choices. It's also the story of Lindsay's own quest to ask: "what really matters?" and to figure out where the answers can take her.