- Table View

- List View

Mission Mastery

by Brian DiveThis book reveals the story of how the first large learning organization was formed. Emerging around 1870, it involved an organizational transformation that followed a disaster some 60 years earlier. The great success of this process was the introduction of a totally new approach to leadership - a competitive edge that would go undetected for another 100 years. The original development involved the Prussian/German Army under a great leader, Helmut von Moltke. NATO countries finally discovered this "secret weapon," which they have since implemented in their mission command centers, in the 1980s. The book distils five underlying features or pillars of the transformed organization, and describes how they can be applied in civilian organizations to attain a state of Mission Mastery. Never before published, these ideas are supplemented by numerous references and practical examples to illustrate the persuasive power of the case made - namely that most civilian organizations are weak in terms of the five key ingredients needed for Mission Mastery. "This book is a must-read for all charged with developing tomorrow's leaders. " Sir Michael Perry, GBE - previously Chairman and Chief Executive Officer at Unilever, Chairman of Centrica, Chairman of the Senior Salaries Review Body, Independent Director at Singapore Technologies Telemedia Pte. Ltd and Chairman of the Faculty Board at the Said Business School, Oxford University. "Mission Mastery is a masterwork. " Professor Stephen J. Perkins, DPhil (Oxon) Dean Guildhall Faculty of Business & Law, London Metropolitan University, UK "No other book on organizational leadership is as relevant today as Mission Mastery". Gerald A. Arbuckle, Organizational Anthropologist, and author of Humanizing Healthcare Reforms

Mission Possible: How to build a business for our times

by Alexandre MarsYou want to build your own business. A profitable business, that's essential, and a good one too. A business that is not only financially successful, but works to propel progress in the world we live in. An impossible dream? Not for Alexandre Mars. Part of a new generation of philanthropists, he is one of the world's most respected entrepreneurs. After founding and selling a string of successful tech starts ups, today he runs a global mission-driven foundation. He works for profit and purpose. Now you can achieve this too. You need to. The world needs you to. If you don't, who will?Packed with ideas, tips and practical examples, Mission Possible gives us a behind-the-scenes look at what it really takes to become an entrepreneur. This is your guide to create, launch and grow your own business. You will discover that it is possible to make money and have a bigger mission too. Get to work and take your lead from insider interviews with many of the world's changemaker entrepreneurs such as the founder of Pinterest and the Buddhist monk who created Headspace. Define your mission then work harder and smarter on it than anyone else. Be successful. Very successful. Because then you can become the true driver of change.

Mission Possible: How to build a business for our times

by Alexandre MarsWhy Anyone Can Be a Good Entrepreneur.You want to build your own business. A profitable business, that's essential, and a good one too. A business that is not only financially successful, but works to propel progress in the world we live in.An impossible dream? Not for Alexandre Mars. Part of a new generation of philanthropists, he is one of the world's most respected entrepreneurs. After founding and selling a string of successful tech starts ups, today he runs a global mission-driven foundation. He works for profit and purpose. Now you can achieve this too.You need to. The world needs you to. If you don't, who will?Packed with ideas, tips and practical examples, Mission Possible gives us a behind-the-scenes look at what it really takes to become an entrepreneur. This is your guide to create, launch and grow your own business. You will discover that it is possible to make money and have a bigger mission too.Get to work and take your lead from insider interviews with many of the world's changemaker entrepreneurs such as the founder of Pinterest and the Buddhist monk who created Headspace. Define your mission then work harder and smarter on it than anyone else.Be successful. Very successful. Because then you can become the true driver of change.(P) 2022 Hodder & Stoughton Limited

Mission Possible: How to build a business for our times

by Alexandre MarsIs entrepreneurship the path for everyone? No. But can anyone, no matter where they come from, become a successful entrepreneur if they choose to? According to Alexandre Mars, the answer is a resounding yes. Serial tech entrepreneur, millionaire and philanthropist Alexandre Mars gives us a behind-the-scenes look at what it really takes to become an entrepreneur, and one who does good along the way, sharing tricks of the trade he learned over his career building companies (and selling them to the likes of Blackberry and Publicis) in the U.S. and Europe.Part of a new generation of philanthropists, Alexandre is one of the leading global entrepreneurial voices changing the way the business world thinks about money, its power and its purpose. Mission Possible reminds us that there's no one way to start and build a business. Bringing together a wealth of perspectives from dozens of today's top entrepreneurs from around the world, including the founder of Pinterest and the former Buddhist monk who created Headspace, readers will discover it is possible to make money and have a bigger mission too.

Mission Possible: The Latin American Agribusiness Development Corporation

by Robert RossThe Latin American Agribusiness Development Corporation (LAAD) was one of many initiatives taken at the height of the Cold War to alleviate poverty in countries threatened by communist insurgencies. Its mission was to promote rural development by funding local agribusiness enterprises to create new permanent jobs and new economic activity. In Mission Possible, Ross, president of LAAD from 1972 to 1998, gives a richly detailed insider's account of the company's first three decades.Originally capitalized with a little over $2 million, and beginning with the small economies of Central America, it gradually expanded into the Caribbean islands and South America and now is a factor in 25 countries. To date, LAAD has provided over $300 million to 700 projects, generating tens of thousands of new jobs and new annual exports of $500 million. Always profitable, it has paid a dividend for twenty years. Its capitalization has grown to over $30 million by reinvesting most of its earnings in Latin America. Since LAAD was committed exclusively to Latin America, it had to contend with an often unsettled political environment; it could not simply stand on the sidelines and wait for conditions to improve. Indeed in a broader sense LAAD's mission was to help improve those conditions.Mission Possible describes a small but significant chapter in a broader context of how the world's rich countries have tried to raise living standards among their poorer neighbors. Students of economic development and international business management will learn much from the story of how this unique experiment grew into a dynamic enterprise."[Ross] offers innumerable studies [in Mission Possible] of investment projects that stimulated the commercial production of agricultural produce in the region. He recounts the frustrating negotiations with uncomprehending central bankers and the difficulties of developing marketing and other infrastructural networks that are so important for assuring the success of any business, and is pleased with what he identifies as the two most significant changes that profoundly affected agriculture: the decline in the role of the state in Latin America and in protectionism in the industrialized world. ... He stresses the fundamental roles that innovative entrepreneurs can play, taking advantage of opportunities created by organizations like LAAD, and using market information to reduce uncertainty." -David Barkin, Latin American Research ReviewRobert L. Ross, a Harvard-educated development economist, has worked for forty years in Latin America. He taught economics at the Latin American Economic and Social Planning Institute in Santiago, Chile and worked on the first development plans in Haiti and Paraguay. He was president of the Latin American Agribusiness Development Corporation from 1972 until his retirement in 1998.

Mission Produce

by Mary Shelman Jose B. AlvarezAs the leading distributor of fresh avocados in the U.S., Mission Produce was at a crossroads in late 2013. Avocado consumption was booming and CEO Steve Barnard wanted to acquire additional land in Peru and develop new avocado farms to help fill a projected supply gap. Mission could also buy avocado farms in other countries, expand its international marketing efforts, invest in brand building in Asia, and/or add processed avocado products. This strategy case describes Mission's growth, entrepreneurial leadership, future opportunities, and financing alternatives.

Mission Statements: A Guide To The Corporate And Nonprofit Sectors

by John W. Graham Wendy C. HavlickFirst published in 1994. Routledge is an imprint of Taylor & Francis, an informa company.

Mission Transition: Navigating the Opportunities and Obstacles to Your Post-Military Career

by Matthew J. LouisMission Transition is an essential career-change guide for any transitioning veteran that wants to avoid false starts and make optimal career choices following active duty.Every year, about a quarter of a million veterans leave the military - most of whom are unprepared for the transition. These service members have developed incredible leadership, problem-solving, and practical skills that are underutilized once they reach the civilian world, a detriment to both themselves and society.Well-intentioned Transition Assistance Programs and other support structures within the armed forces often leave veterans fending for themselves. The mission-first culture of the military results in service members focusing on their active duty roles in the year leading up to their separation, leaving them little time to adequately prepare to join the civilian world.President of Purepost, a next-generation staffing solution and public benefits corporation, and author Matthew J. Louis guides military personnel through the entire process of making a successful move into civilian professional life.In Mission Transition, this book will:Guide you through the process of discovering what path you want to take going forwardTeach you the strategies that will make your résumé stand outProvide suggestions to help you prepare for and ace the interviewDiscuss ways to acclimate to your new organization&’s culture and pay it forward to other veteransEach chapter includes advice from other veterans, illustrations of key concepts, summaries, and suggested resources. Let this well-written and easy to follow guidebook help you transition out from the military and commit to being successful in the next chapter of your life.

Mission Wandel: Von einem Old-School-Unternehmen zu einer Tech-Company – die Geschichte einer Transformation

by Peter F. SchmidIn diesem Buch erzählt der neu bestellte Geschäftsführer eines zuvor traditionell aufgestellten mittelständischen Unternehmens die Geschichte einer kulturellen Transformation: weg von „Wir sind einfach die Besten“, hin zu kontinuierlicher Veränderung, Digitalisierung, Beweglichkeit und Internationalisierung. Er beschreibt den lebendigen Change-Management-Prozesses, von einem Verlagshaus zu einer agil arbeitenden Tech-Company, der durch Radikalität und Ausdauer letztlich zu notwendigem Wachstum und nachhaltigem Erfolg geführt hat. Ein Kernelement des Erfolges war dabei, sämtliche etablierten Denk- und Handlungsmuster über Bord zu werfen und zwar mit Blick auf folgende Themen:Die Vision – wohin soll die Reise gehen? Die Strategie – wie gelangen wir dorthin? Die Organisation – der strukturelle Aufbau und die internen Abläufe.Die Mitarbeiter – welche brauchen wir, wen wollen wir halten, wen neu gewinnen? Die Kultur – wie wollen wir zukünftig arbeiten und uns kontinuierlich ändernDas Zeitalter der Digitalisierung und Globalisierung fordert Innovation und Beweglichkeit. Es verlangt auch Investitionen sowie ein generelles Umdenken über die bisherigen Konstanten Kunde, Konkurrenz und Geschäftsmodell. Nicht zuletzt ist ein Führungsstil gefragt, der kluge Köpfe anzieht, fördert und hält.Dieses Buch soll Unternehmer, Manager und Macher ermutigen, aktiv und methodisch durchdacht Veränderungsprozesse einzuleiten, um ihr Unternehmen jetzt zukunftsfähig und langfristig erfolgreich zu machen. Es zeigt anhand eines real durchlebten Prozesses exemplarisch alle notwendigen Schritte auf.

Mission and Money

by Burton A. Weisbrod Jeffrey P. Ballou Evelyn D. Asch Burton A. Weisbrod Jeffrey P. BallouMission and Money goes beyond the common focus on elite universities and examines the entire higher education industry, including the rapidly growing for-profit schools. The sector includes research universities, four-year colleges, two-year schools, and non-degree-granting career academies. Many institutions pursue mission-related activities that are often unprofitable and engage in profitable revenue raising activities to finance them. This book contains a good deal of original research on schools' revenue sources from tuition, donations, research, patents, endowments, and other activities. It considers lobbying, distance education, and the world market, as well as advertising, branding, and reputation. The pursuit of revenue, while essential to achieve the mission of higher learning, is sometimes in conflict with that mission itself. The tension between mission and money is also highlighted in the chapter on the profitability of intercollegiate athletics. The concluding chapter investigates implications of the analysis for public policy.

Mission edX: Balancing Social Good and Financial Sustainability

by David J. Collis John J-H Kim James BarnettIn March 2021, online education platform edX considers how to achieve financial sustainability without compromising its mission to provide universal access to high-quality education.

Mission in a Bottle: The Honest Guide to Doing Business Differently--and Succeeding

by Sungyoon Choi Barry Nalebuff Seth GoldmanIn an incredibly fun and accessible two-color graphic-book format, the cofounders of Honest Tea tell the engaging story of how they created and built a mission-driven business, offering a wealth of insights and advice to entrepreneurs, would-be entrepreneurs, and millions of Honest Tea drinkers about the challenges and hurdles of creating a successful business--and the importance of perseverance and creative problem-solving.Seth Goldman and Barry Nalebuff began Honest Tea fifteen years ago with little more than a tea leaf of an idea and a passion to offer organic, freshly brewed, lightly sweetened bottled tea. Today Honest Tea is a rapidly expanding national brand sold in more than 100,0000 grocery stores, restaurants, convenience stores and drugstores across the country. The brand has flourished as American consumers move toward healthier and greener lifestyles.

Mission, Inc.: The Practitioners Guide to Social Enterprise

by Kevin Lynch Julius WallsIn this groundbreaking book, Julius Walls and Kevin Lynch offer a complete guide to confronting the complexities these businesses present.

Mission, Inc.: The Practitioners Guide to Social Enterprise (false)

by Kevin Lynch Julius Walls, Jr.Business has the power to change the world, but some businesses embrace that opportunity more aggressively than others do. Social enterprises put their change mission first – what they sell or what service they provide is a means to accomplishing a larger goal, rather than an end in itself. Their front-and-center commitment to doing good makes social enterprises immensely attractive. But if you want to run one successfully, you have to manage a tricky balancing act. How can you be as efficient as any of your for-profit or nonprofit competitors while at the same time staying true to your social purpose? In this groundbreaking guide, social entrepreneurs Kevin Lynch and Julius Walls draw on their own extensive experiences and those of twenty other social enterprise leaders to focus on the fundamental blocking and tackling tactics that make the difference between success and failure. Exploring the many paradoxes that can hamstring social enterprises, the authors explain how starting and running a social enterprise requires leaders to adopt an entirely different mindset and often a wholly different perspective on the day-to-day choices they’re forced to make. Likewise, Walls and Lynch help readers grapple with a different set of expectations from employees, investors, customers, and the community. For social enterprise practitioners, these expectations present an added layer of difficulty – but they can also offer unique advantages, which the authors explain how to leverage. Whether readers are looking for guidance on finding and hiring talent, marketing, finances, or scaling, this practical, accessible guide offers clear and compelling answers that light the way.

Mission-Based Management

by Peter C. BrinckerhoffThe only nonprofit management book you must have-in an exciting new editionAs a nonprofit manager, you have to be more effective and more efficient than ever to win funding and support to ensure your organization pursues its mission, meets community needs, and maintains its budget, while juggling the demands of funders, clientele, boards, staff, and community. This Third Edition of Mission-Based Management provides comprehensive, hands-on guidance that addresses your unique concerns as a nonprofit manager and policy-makerAddresses the effects of SOX, organizational transparency, new technologies, technology planning, and marketing in today's environmentIs written by a nationally recognized expert who has trained thousands of nonprofit managers in hundreds of seminars on the best practices in nonprofit managementIncludes in each chapter a recap and a list of questions for group discussionMore than ever before, as a nonprofit manager, you want and need practical guidance on how to do your job and run your organization more effectively and efficiently. And more than ever before, Mission-Based Management, Third Edition provides the definitive answer.

Mission-Based Marketing

by Peter C. BrinckerhoffA direct, practical guide revealing how you can lead your not-for-profit to success through mission-based marketing Now in a Third Edition, Mission-Based Marketing is a direct, practical guide showing how you can lead your not-for-profit to success in a more competitive world. This book provides the knowledge and skills you need to build a market-driven organization that holds onto its core values, does a better job of providing mission, and successfully competes for funding, clients, referral sources, staff, and board members. Includes new material on nonprofit websites, social networking and new methods of communication, advances in technology, customer service in today's world, and the effects of marketing on fundraising Goes beyond the hows and whys to include lots of hands-on advice and real-world examples Other titles by Brinckerhoff: Mission-Based Management: Leading Your Not-for-Profit In the 21st Century, Faith-Based Management: Leading Organizations That Are Based on More than Just Mission, and Social Entrepreneurship: The Art of Mission-Based Venture Development Filled with new material, this book appraises the trends that have dramatically affected the not-for-profit sector in the past several years, and explains how an organization can shape this shifting landscape to its ultimate benefit.

Mission-Driven Leadership: My Journey as a Radical Capitalist

by Mark BertoliniIn Mission-Driven Leadership, Mark Bertolini, the long-time chairman and CEO of Aetna, the Fortune 500 health insurance company, reveals that genuine leadership is not about dollars and market share but about improving lives and communities.Mark Bertolini didn't get to the corner office through traditional means. He grew up in a blue-collar neighborhood in Detroit. Early in his career, he was known for his bare-knuckled leadership and hard driving competitiveness that helped him to turnaround several companies. But his ambition came at a cost as he ran roughshod over his colleagues and employees, and spent time away from his family. Two events served as wakeup calls for the hard-charging Bertolini. First his son Eric was diagnosed with incurable cancer, and Bertolini found himself confronting the healthcare industry firsthand, not as an executive, but as the parent of a deathly ill child, determined to save his son's life. And miraculously, after a year in the hospital, often at death's door--Eric was twice given last rites--his son recovered. The second wakeup call was a skiing accident several years later in which Bertolini broke his neck. As his life unraveled in the face of years of chronic pain, therapy, and medication, he realized he had to reinvent himself, emotionally, spiritually, and as a leader--or go under. Mission-Driven Leadership speaks to the lessons Bertolini learned about empathy, about helping employees and Aetna's customers take better care of themselves and each other, about the need to "find the divine in me," and the importance of getting out to meet with employees and customers face-to-face in town halls to truly discover their needs and better serve them.

Mission: How the Best in Business Break Through

by Michael Hayman Nick GilesIn Mission: How the Best in Business Break Through, Michael Hayman and Nick Giles show companies how to join the ranks of today's business winners.Business as usual is over. Belief is the new currency and to succeed you must follow new rules: purpose as the route to profit; mind share to gain market share.The best in business are defined by mission: a singular cause, a defining ambition. They stand out as campaigners, activists fighting to lead industries and redefine them. And they win through with momentum, explosive growth that outruns the competition.From tech pioneers Google and Airbnb, to retail giant Whole Foods and British success stories such as Ella's Kitchen, Mission shows how business is changing people's lives through the power of purpose, culture and campaigning. How caring, sharing and daring companies have opened a new chapter for the world of business.Uncover the secrets of what it takes to succeed: how to discover and define your commercial purpose, hone it into a campaign and turn customers into advocates. Harness the power of momentum. Find your mission.

Missionary Capitalist

by Darlene RivasThe first work to draw on Nelson A. Rockefeller's newly available personal papers as well as research in Latin American archives, Missionary Capitalist details Rockefeller's efforts to promote economic development in Latin America, particularly Venezuela, from the late 1930s through the 1950s. Rockefeller's involvement in the region began in 1936 with his investment in Creole Petroleum, the Venezuelan subsidiary of Standard Oil. Almost immediately, he began trying to influence North Americans' individual, corporate, and government relationships with Latin Americans. Through his work developing technical assistance programs for the Roosevelt administration during World War II, his business ventures (primarily agricultural production and food retailing), and his postwar founding of the nonprofit American International Association, Rockefeller hoped to demonstrate how U.S. capitalists could nurture entrepreneurial spirit and work successfully with government agencies in Latin America to encourage economic development and improve U.S.-Latin American relations. Ultimately, however, he overestimated the ability of the United States, through public or private endeavors, to promote Latin American economic, political, and social change. This objective account paints a portrait of Rockefeller not as the rapacious, exploitative figure of stereotype, but as a man fueled by idealism and humanitarian concern as well as ambition.

Mississippi Entrepreneurs

by Polly DementThe stories in Mississippi Entrepreneurs collectively draw attention to the tenacious and courageous journeys of Mississippi men and women who risk fortune and futures to create successful enterprises. Most tell “how they did it” uniquely and in their own words, bringing to life their entrepreneurial spirits. Family members and former colleagues pick up the storyline for legendary entrepreneurs who have passed on, recalling vividly the characteristics that set them apart from the competition. Usually a passion for creation inspired these go-getters—whether casting red-hot liquid steel into industrial products (Fred Wile, Meridian); constructing buildings (Roy Anderson III, Gulfport; Bill Yates Jr., Philadelphia; and William Yates III, Biloxi); making agricultural products grow (Janice and Allen Eubanks, Lucedale; and Mike Sanders, Cleveland); delivering and installing furniture (Johnnie Terry, Jackson); using technology to improve systems (John Palmer and Joel Bomgar, and Toni and Bill Cooley, Jackson; and Billy and Linda Howard, Laurel); expanding food operations (Dr. S. L. Sethi, Jackson; and Don Newcomb, Oxford); or sharing the sheer love of music (Hartley Peavey, Meridian), food (Robert St. John, Hattiesburg), art (Erin Hayne and Nuno Gonçalves Ferreira, Jackson), or books (John Evans, Jackson; and Richard Howorth, Oxford). Social and cultural entrepreneurs made their marks as well, including those focused on social justice (Martha Bergmark, Jackson); access to health care (Aaron Shirley, Jackson); and public education (Jack Reed, Tupelo). Few if any books have focused exclusively on this aspect of the state's history. Altogether the stories, accompanied by seventy black-and-white photographs, illustrate common traits, including plentiful vision, fierce drive, willingness to take risks and change for a better way, the ability to innovate, solve problems, and turn luck (both good and bad) to advantage. Most of these entrepreneurs generously share the rewards of their hard work and ingenuity with their communities.

Mississippi Harvest: Lumbering in the Longleaf Pine Belt, 1840-1915

by Nollie W. HickmanIn this classic work of Mississippi history, Nollie W. Hickman relates the felling of great forests of longleaf pine in a southern state where lumbering became a mighty industry. Mississippi Harvest records the arduous transportation of logs to the mills, at first by oxcart and water and later by rail. It details how the naval stores trade flourished through the production of turpentine, pitch, and rosin and through the expansion of exports, which furnished France with spars for sailing vessels. The book tracks the impact of the Civil War on southern lumbering, the tragedy of denuded lands, and, finally, the renewal of resources through reforestation. Born into a family of lumbermen, Hickman acquired firsthand knowledge of forest industries. Later, as a student of history, he devoted years of painstaking work to gathering materials on lumbering. His information comes from many sources, including interviews with loggers, rafters, sawmill and turpentine workers, and company managers, and from company records, land records, diaries, old newspapers, lumber trade journals, and government documents. While the author's purpose is to share the history of a natural resource, he also gives the reader the panorama of Mississippi. Mississippi Harvest interprets the state's people, agriculture, industry, government, politics, economy, and culture through the lens of one of the state's earliest and most lasting economic engines.

Mistake Proofing for Lean Healthcare (Lean Tools for Healthcare Series)

by Samuel Carlson Maura MayThe principles of mistake proofing, long used to eliminate errors and defects across a range of industries, are now being applied in healthcare organizations around the world to help ensure patient safety, improve services, and eliminate waste.Mistake Proofing for Lean Healthcare is based on the definitive mistake-proofing philosophy and system developed by Shigeo Shingo. This reader-friendly book introduces the main concepts and benefits of mistake proofing in healthcare and highlights common reasons that errors and defects occur. It also explains how to catch errors before they become defects, using the concept of source inspection, so you can ensure quality before a process is performed instead of afterward. When systematically used, the mistake-proofing approach explained in this book will help you:Create safer, more reliable, and more effective healthcare services for both patients and staffEstablish a culture in which mistakes and the conditions that cause them are readily surfaced so they can be correctedLay the foundation for processes that flow smoothly, without disruptionEliminate rework, waste, and the need for extra resources and suppliesPresenting real-world healthcare examples, the book shows different types of mistake-proofing devices and methods (poka-yoke) that provide feedback quickly and automatically to prevent errors and defects.The book is part of the Lean Healthcare Series and is designed for individual or group learning. Each chapter includes reflection questions to facilitate understanding and stimulate discussion and action.

Mistakes I Made at Work

by Jessica BacalHigh-achieving women share their worst mistakes at work--and how learning from them paved the way to success. Named by Fast Company as a "Top 10 Book You Need to Read This Year" In Mistakes I Made at Work, a Publishers Weekly Top 10 Business Book for Spring 2014, Jessica Bacal interviews twenty-five successful women about their toughest on-the-job moments. These innovators across a variety of fields - from the arts to finance to tech - reveal that they're more thoughtful, purposeful and assertive as leaders because they learned from their mistakes, not because they never made any. Interviewees include: Cheryl Strayed, bestselling author of Wild Anna Holmes, founding editor of Jezebel.com Kim Gordon, founding member of the band Sonic Youth Joanna Barsch, Director Emeritus of McKinsey & Company Carol Dweck, Stanford psychology professor Ruth Ozeki, New York Times bestselling author of Tale for the Time Being And many more Ideal for millenials just starting their careers, for women seeking to advance at work, or for anyone grappling with issues of perfectionism, Mistakes I Made at Work features fascinating and surprising anecdotes, as well as tips for readers.

Mistakes Were Made (but Not By Me) Third Edition: Why We Justify Foolish Beliefs, Bad Decisions, and Hurtful Acts

by Elliot Aronson Carol TavrisA NEW EDITION UPDATED IN 2020 • Why is it so hard to say "I made a mistake" — and really believe it? When we make mistakes, cling to outdated attitudes, or mistreat other people, we must calm the cognitive dissonance that jars our feelings of self-worth. And so, unconsciously, we create fictions that absolve us of responsibility, restoring our belief that we are smart, moral, and right—a belief that often keeps us on a course that is dumb, immoral, and wrong. Backed by decades of research, Mistakes Were Made (But Not by Me) offers a fascinating explanation of self-justification—how it works, the damage it can cause, and how we can overcome it. Extensively updated, this third edition has many recent and revealing examples, including the application of dissonance theory to divisive social issues such as the Black Lives Matter movement and he said/she said claims. It also features a new chapter that illuminates how cognitive dissonance is playing a role in the currently polarized political scene, changing the nation&’s values and putting democracy itself at risk. &“Every page sparkles with sharp insight and keen observation. Mistakes were made—but not in this book!&” —Daniel Gilbert, author of Stumbling on Happiness &“A revelatory study of how lovers, lawyers, doctors, politicians—and all of us—pull the wool over our own eyes . . . Reading it, we recognize the behavior of our leaders, our loved ones, and—if we&’re honest—ourselves, and some of the more perplexing mysteries of human nature begin to seem a little clearer.&” —Francine Prose, O, The Oprah Magazine

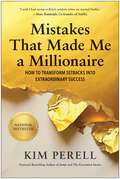

Mistakes that Made Me a Millionaire: How to Transform Setbacks into Extraordinary Success

by Kim PerellAre you ready to turn your mistakes into millions and fast-track your way to success? Mistakes That Made Me a Millionaire is your permission slip to fail forward, dream bigger, and discover that behind every mistake is a million-dollar lesson. Through powerful stories, proven strategies, and real-world advice, self-made millionaire Kim Perell reveals the untold truth: Success is built in the messy middle, between your worst moments and your best decisions. Ten chapters. Ten mistakes. Ten secrets no millionaire talks about—until now. In these pages, you will learn: How to stop playing small, overcome imposter syndrome, and own your success The mindset shift that turns mistakes into million-dollar lessons The ultimate tool kit for handling mistakes and setbacks How to remove barriers to take your professional career to the next level The secret to unlocking the power of relationships to multiply your success Whether you&’re an entrepreneur, aspiring leader, high-achieving professional, executive climbing the corporate ladder, or starting your next big chapter—these lessons will meet you where you are and take you where you want to go. Kim&’s tenacious and triumphant story serves as an essential guide to elevate your leadership, empower your teams, and embrace life&’s toughest challenges. Mistakes That Made Me a Millionaire is a must-read master class from a world-class entrepreneur.