- Table View

- List View

Mode & Musik

by Jochen SträhleDieses Buch wird das Verständnis der Leser für die Verbindungen zwischen der Musik- und der Modeindustrie erweitern. Es hebt die Herausforderungen hervor, denen sich die Modeindustrie derzeit in Bezug auf den Hyperwettbewerb, die Definition immer schnellerer Trends, sich ändernde Verbraucherwünsche usw. gegenübersieht. Die Modeindustrie wird in der Tat stark von der digitalen Revolution in der Musikindustrie beeinflusst, die das Gesicht des individuellen Musikkonsums und des sozialen Bezugs verändert hat und sich daher auch auf den Modekonsum und den sozialen Bezug auswirkt. Dieses Verständnis ist von entscheidender Bedeutung, um die Strategien eines Modeunternehmens auf die Anforderungen der modernen Modekonsumenten auszurichten. Inhaltlich befasst sich das Buch zunächst mit der sozialen Perspektive von Mode und Musik. Dazu gehört eine Analyse der Musik als wichtiger Einflussfaktor für Modetrends, sowohl theoretisch als auch anhand einer Fallstudie über Grunge-Musik. Anschließend wird die Rolle der Musik in der Modebranche behandelt, wobei die Musik in den Geschäften und die Rolle der Musik in der Modekommunikation behandelt werden. Im Anschluss daran wird die Rolle der Mode im Musikgeschäft analysiert. Dazu gehören der Trend zum Co-Design von Modekollektionen, die Rolle von Musikkünstlern bei der Differenzierung nach Stilrichtungen und der Markt für Musik-Mode-Merchandise-Artikel (sowohl theoretisch als auch anhand einer Fallstudie). Abschließend werden mögliche Lehren aus der Musikindustrie für die Modeindustrie gezogen. Dazu gehört auch eine Analyse der digitalen Revolution und des Aufkommens der Crowdfunding-Idee (sowohl theoretisch als auch in einer Fallstudie).

Mode 3 Knowledge Production in Quadruple Helix Innovation Systems

by Elias G. Carayannis David F.J. CampbellDeveloped and developing economies alike face increased resource scarcity and competitive rivalry. In this context, science and technology appear as an essential source of competitive and sustainable advantage at national and regional levels. However, the key determinant of their efficacy is the quality and quantity of entrepreneurship-enabled innovation that unlocks and captures the benefits of the science enterprise in the form of private, public or hybrid goods. Linking basic and applied research with the market, via technology transfer and commercialization mechanisms, including government-university-industry partnerships and capital investments, constitutes the essential trigger mechanism and driving force of sustainable competitive advantage and prosperity. In this volume, the authors define the terms and principles of knowledge creation, diffusion, and use, and establish a theoretical framework for their study. In particular, they focus on the "Quadruple Helix" model, through which government, academia, industry, and civil society are seen as key actors promoting a democratic approach to innovation through which strategy development and decision making are exposed to feedback from key stakeholders, resulting in socially accountable policies and practices.

Model Averaging (SpringerBriefs in Statistics)

by David FletcherThis book provides a concise and accessible overview of model averaging, with a focus on applications. Model averaging is a common means of allowing for model uncertainty when analysing data, and has been used in a wide range of application areas, such as ecology, econometrics, meteorology and pharmacology. The book presents an overview of the methods developed in this area, illustrating many of them with examples from the life sciences involving real-world data. It also includes an extensive list of references and suggestions for further research. Further, it clearly demonstrates the links between the methods developed in statistics, econometrics and machine learning, as well as the connection between the Bayesian and frequentist approaches to model averaging. The book appeals to statisticians and scientists interested in what methods are available, how they differ and what is known about their properties. It is assumed that readers are familiar with the basic concepts of statistical theory and modelling, including probability, likelihood and generalized linear models.

Model Britain: The Architectural Models of Twentieth Century Dreams

by David LundThroughout the twentieth century architectural models served as the miniature playgrounds in which the future of Britain’s built environment was imagined, and in drawing from the evidence provided by those models today, this book considers how architects, planners, and civil engineers thought about that future by presenting a history of yesterday’s dreams of tomorrow, told through architectural models.Focused not on the making of architectural models but rather the optimistic and utopian visions they were made to communicate, this book examines the possible futures put forward by 120 models made by Thorp, the oldest and most prolific firm of architectural modelmakers in Britain, in order to reveal a century of evolving ideas about how we might live, work, relax, and move. From depictions of unbuilt city masterplans to those of seemingly ordinary shopping centres and motorways, the models featured trace a progression of the architectural, social, political, technological, and economic influences that shaped the design of Britain’s buildings, transport infrastructure, and its towns and cities during a century of relentless change.Illustrated with over 130 photographs, this book will appeal to academics and historians, as well as anyone with an interest in architectural models and the history of Britain’s twentieth century built environment.

Model Building in Economics

by Lawrence A. BolandConcern about the role and the limits of modeling has heightened after repeated questions were raised regarding the dependability and suitability of the models that were used in the run-up to the 2008 financial crash. In this book, Lawrence Boland provides an overview of the practices of and the problems faced by model builders to explain the nature of models, the modeling process, and the possibility for and nature of their testing. In a reflective manner, the author raises serious questions about the assumptions and judgments that model builders make in constructing models. In making his case, he examines the traditional microeconomics-macroeconomics separation with regard to how theoretical models are built and used and how they interact, paying particular attention to the use of equilibrium concepts in macroeconomic models and game theory and to the challenges involved in building empirical models, testing models, and using models to test theoretical explanations.

Model Building in Mathematical Programming

by H. Paul WilliamsThe 5th edition of Model Building in Mathematical Programming discusses the general principles of model building in mathematical programming and demonstrates how they can be applied by using several simplified but practical problems from widely different contexts. Suggested formulations and solutions are given together with some computational experience to give the reader a feel for the computational difficulty of solving that particular type of model. Furthermore, this book illustrates the scope and limitations of mathematical programming, and shows how it can be applied to real situations. By emphasizing the importance of the building and interpreting of models rather than the solution process, the author attempts to fill a gap left by the many works which concentrate on the algorithmic side of the subject.

Model Choice in Nonnested Families

by Basilio De Pereira Carlos Alberto PereiraThis book discusses the problem of model choice when the statistical models are separate, also called nonnested. Chapter 1 provides an introduction, motivating examples and a general overview of the problem. Chapter 2 presents the classical or frequentist approach to the problem as well as several alternative procedures and their properties. Chapter 3 explores the Bayesian approach, the limitations of the classical Bayes factors and the proposed alternative Bayes factors to overcome these limitations. It also discusses a significance Bayesian procedure. Lastly, Chapter 4 examines the pure likelihood approach. Various real-data examples and computer simulations are provided throughout the text.

Model Overview: The 90 Days Transformation Model

by Robert J. Dolan Behnam Tabrizi Leslie K. JohnCompanies need to constantly reinvent themselves to remain competitive in today's world. The 90 days transformation model presented in this chapter provides companies with a framework for transforming themselves in order to stay ahead of the curve.

Model Predictive Control: Engineering Methods for Economists (Dynamic Modeling and Econometrics in Economics and Finance #31)

by Lars Grüne Gernot Tragler Josef Haunschmied Aris DaniilidisThe book explores the field of model predictive control (MPC). It reports on the latest developments in MPC, current applications, and presents various subfields of MPC. The book features topics such as uncertain and stochastic MPC variants, learning and neural network approaches, easy-to-use numerical implementations as well as multi-agent systems and scheduling and coordination tasks. While MPC is rooted in engineering science, this book illustrates the potential of using MPC theory and methods in non-engineering sciences and applications such as economics, finance, and environmental sciences.

Model Rebels: The Rise and Fall of China's Richest Village

by Bruce GilleyThis narrative about rural life and development in post-Mao China which also engages a scholarly political science debate about the reasons for political resistance.

Model Rules Of Professional Conduct

by Center For ProfessionalThe Rules, with some variations, have been adopted in 50 jurisdictions. Federal, state, and local courts in all jurisdictions look to the Rules for guidance in resolving lawyer malpractice cases, disciplinary actions, disqualification issues, sanctions questions, and much more.

Model Validation and Uncertainty Quantification, Volume 3: Proceedings of the 40th IMAC, A Conference and Exposition on Structural Dynamics 2022 (Conference Proceedings of the Society for Experimental Mechanics Series)

by Zhu MaoModel Validation and Uncertainty Quantification, Volume 3: Proceedings of the 40th IMAC, A Conference and Exposition on Structural Dynamics, 2022, the third volume of nine from the Conference brings together contributions to this important area of research and engineering. The collection presents early findings and case studies on fundamental and applied aspects of Model Validation and Uncertainty Quantification, including papers on:Uncertainty Quantification and Propagation in Structural DynamicsBayesian Analysis for Real-Time Monitoring and MaintenanceUncertainty in Early Stage DesignQuantification of Model-Form UncertaintiesFusion of Test and AnalysisMVUQ in Action

Model Woman: Eileen Ford and the Business of Beauty

by Robert LaceyA revealing, no-holds-barred portrait of the legendary Eileen Ford—the entrepreneur who transformed the business of modeling and helped invent the celebrity supermodel.Working with her husband, Jerry, Eileen Ford created the twentieth century’s largest and most successful modeling agency, representing some of the fashion world’s most famous names—Suzy Parker, Carmen Dell’Orefice, Lauren Hutton, Rene Russo, Christie Brinkley, Jerry Hall, Christy Turlington, and Naomi Campbell. Her relentless ambition turned the business of modeling into one of the most glamorous and desired professions, helping to convert her stable of beautiful faces into millionaire superstars.Model Woman chronicles the Ford Modeling Agency’s meteoric rise to the top of the fashion and beauty business, and paints a vibrant portrait of the uncompromising woman at its helm in all her glittering, tyrannical brilliance. Outspoken and controversial, Ford was never afraid to offend in defense of her stringent standards. When she chose, she could deliver hauteur in the grand tradition of fashion’s battle-axes, from Coco Chanel to Diana Vreeland—just ask John Casablancas or Janice Dickinson. But she was also a shrewd businesswoman with a keen eye for talent and a passion for serving her clients.Drawing on more than four years of intensive interviews with Ford and her intimates, associates, and rivals, as well as exclusive access to agency documents and memorabilia, Robert Lacey weaves an unforgettable tale of a determined entrepreneur and the empire she built—a story of beauty, ambition, business, and popular culture as powerful and complex as the woman at its center.

Model-Based Development and Evolution of Information Systems

by John KrogstieThis book introduces and describes in detail the SEQUAL framework for understanding the quality of models and modeling languages, including the numerous specializations of the generic framework, and the various ways in which this can be used for different applications. Topics and features: contains case studies, chapter summaries, review questions, problems and exercises throughout the text, in addition to Appendices on terminology and abbreviations; presents a thorough introduction to the most important concepts in conceptual modeling, including the underlying philosophical outlook on the quality of models; describes the basic tasks and model types in information systems development and evolution, and the main methodologies for mixing different phases of information system development; provides an overview of the general mechanisms and perspectives used in conceptual modeling; predicts future trends in technological development, and discusses how the role of modeling can be envisaged in this landscape.

Model-Driven Organizational and Business Agility: Second International Workshop, MOBA 2022, Leuven, Belgium, June 6–7, 2022, Revised Selected Papers (Lecture Notes in Business Information Processing #457)

by Eduard Babkin Joseph Barjis Pavel Malyzhenkov Vojtěch MerunkaThis book constitutes the proceedings of the Second International Workshop on Model-Driven Organizational and Business Agility, MOBA 2022, which took place in Leuven, Belgium, in June 2022.MOBA was launched with the purpose of fetching scientific rigor into the agile practice within an entire enterprise, especially focusing on the role of models and modeling. The 10 papers presented in this volume were carefully reviewed and selected from 22 submissions. They cover topics like business intelligence, agile business rules, agile software development, adaptive domain-specific interfaces, or reconfigurable software architectures.

Model-Driven Organizational and Business Agility: Third International Workshop, MOBA 2023, Zaragoza, Spain, June 12–13, 2023, Revised Selected Papers (Lecture Notes in Business Information Processing #488)

by Eduard Babkin Joseph Barjis Martin Molhanec Pavel Malyzhenkov Vojtěch MerunkaThis book constitutes the proceedings of the Third International Workshop on Model-Driven Organizational and Business Agility, MOBA 2023, which took place in Zaragoza, Spain, in June 2023. MOBA was launched with the purpose of fetching scientific rigor into the agile practice within an entire enterprise, especially focusing on the role of models and modeling. The 9 papers presented in this volume were carefully reviewed and selected from 18 submissions. They cover topics like business intelligence, agile business rules, agile software development, adaptive domain-specific interfaces, or reconfigurable software architectures.

Model-Driven Risk Analysis: The CORAS Approach

by Ketil Stølen Bjørnar Solhaug Mass Soldal LundThe term "risk" is known from many fields, and we are used to references to contractual risk, economic risk, operational risk, legal risk, security risk, and so forth. We conduct risk analysis, using either offensive or defensive approaches to identify and assess risk. Offensive approaches are concerned with balancing potential gain against risk of investment loss, while defensive approaches are concerned with protecting assets that already exist. In this book, Lund, Solhaug and Stølen focus on defensive risk analysis, and more explicitly on a particular approach called CORAS. CORAS is a model-driven method for defensive risk analysis featuring a tool-supported modelling language specially designed to model risks. Their book serves as an introduction to risk analysis in general, including the central concepts and notions in risk analysis and their relations. The authors' aim is to support risk analysts in conducting structured and stepwise risk analysis. To this end, the book is divided into three main parts. Part I of the book introduces and demonstrates the central concepts and notation used in CORAS, and is largely example-driven. Part II gives a thorough description of the CORAS method and modelling language. After having completed this part of the book, the reader should know enough to use the method in practice. Finally, Part III addresses issues that require special attention and treatment, but still are often encountered in real-life risk analysis and for which CORAS offers helpful advice and assistance. This part also includes a short presentation of the CORAS tool support. The main target groups of the book are IT practitioners and students at graduate or undergraduate level. They will appreciate a concise introduction into the emerging field of risk analysis, supported by a sound methodology, and completed with numerous examples and detailed guidelines.

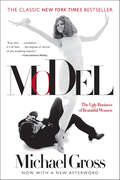

Model: The Ugly Business of Beautiful Women

by Michael GrossInvestigative journalist Michael Gross delves into the history of models and takes us into the private studios and hidden villas where models play and are preyed upon, going beyond modeling’s carefully constructed facade of glamour to expose the scandal and untold truths that permeate the seemingly glamorous business.Here for the first time is the complete story of the international model business—and its evil twin: legalized flesh peddling. It’s a tale of vast sums of money, rape both symbolic and of the flesh, sex and drugs, obsession and tragic death. At its heart is the most unholy combination in commerce: beautiful, young women and rich, lascivious men.Fashion insider Michael Gross has interviewed modeling’s pioneers, survivors, and hangers–on, and he tells the story of the greats: Lisa Fonssagrives; Anita Colby, Candy Jones; Dorian Leigh and her sister Suzy Parker; Jean Shrimpton and Twiggy; Veruschka and Lauren Hutton; and today’s supermodel trinity, Christy, Naomi and Linda.

Modeling Applications in the Airline Industry

by Ahmed Abdelghany Khaled AbdelghanyModeling Applications in the Airline Industry explains the different functions and tactics performed by airlines during their planning and operation phases. Each function receives a full explanation of the challenges it brings and a solution methodology is presented, supported by numerical illustrative examples wherever possible. The book also highlights the main limitations of current practice and provides a brief description of future work related to each function. The authors have filtered the rich literature of airline management to include only the research that has actually been adopted by the airlines, giving a genuinely accurate representation of real airline management and its continuing development of solution methodologies. The book consists of 20 chapters divided into 4 sections: - Demand Modeling and Forecasting - Scheduling of Resources - Revenue Management - Irregular Operations Management. The book will be a valuable source or a handbook for individuals seeking a career in airline management. Written by experts with significant working experience within the industry, it offers readers insights to the real practice of operations modelling. In particular the book makes accessible the complexities of the key airline functions and explains the interrelation between them.

Modeling Complex Linguistic Information to Support Group Decision Making Under Uncertainty: Theories, Methods and Applications (Uncertainty and Operations Research)

by Zhen Zhang Wenyu Yu Zhuolin LiThis book systematically explores theories related to linguistic computational models and group decision making methods under uncertainty. It introduces innovative linguistic computational models capable of fusing complex linguistic information, including multi-granular linguistic information, unbalanced linguistic information and hesitant fuzzy linguistic information. Building upon the linguistic computational models, this book presents methods tailored to various types of group decision making problems under uncertainty. Additionally, it delves into group decision making problems where the personalized individual semantics of experts are considered. The book also showcases practical applications of the proposed group decision making methods, ranging from ERP system supplier selection to talent recruitment, subway line selection, and location selection for electric vehicle charging stations. By shedding light on novel models for modeling complex linguistic information and introducing new approaches to addressing linguistic group decision making challenges, this book offers valuable insights for engineers, researchers, and postgraduates interested in decision analysis, operations research, computational intelligence, management science and engineering, and related fields.

Modeling Discrete Competitive Facility Location

by Athanasia KarakitsiouThis book presents an up-to-date review of modeling and optimization approaches for location problems along with a new bi-level programming methodology which captures the effect of competition of both producers and customers on facility location decisions. While many optimization approaches simplify location problems by assuming decision making in isolation, this monograph focuses on models which take into account the competitive environment in which such decisions are made. New insights in modeling, algorithmic and theoretical possibilities are opened by this approach and new applications are possible. Competition on equal term plus competition between market leader and followers are considered in this study, consequently bi-level optimization methodology is emphasized and further developed. This book provides insights regarding modeling complexity and algorithmic approaches to discrete competitive location problems. In traditional location modeling, assignment of customer demands to supply sources are made for which the associated costs target the firm and not the customers, though in many real world situations the cost is incurred by the customers. Moreover, there may be customer competition for the provided services. Thus, a new methodological framework is needed in order to encompass such considerations into the modeling and solution process. This book offers initial directions for further research and development along these lines. Aimed toward graduate students and researchers in the field of mathematics, computer science, operational research and game theory, this title provides necessary information on which further research contributions can be based.

Modeling Dynamic Economic Systems

by Bruce Hannon Matthias RuthThis book explores the dynamic processes in economic systems, concentrating on the extraction and use of the natural resources required to meet economic needs. Sections cover methods for dynamic modeling in economics, microeconomic models of firms, modeling optimal use of both nonrenewable and renewable resources, and chaos in economic models. This book does not require a substantial background in mathematics or computer science.

Modeling Economic Instability: A History of Early Macroeconomics (Springer Studies in the History of Economic Thought)

by Michaël Assous Vincent CarretThis book offers a fresh perspective on the early history of macroeconomics, by examining the macro-dynamic models developed from the late 1920s to the late 1940s, and their treatment of economic instability. It first explores the differences and similarities between the early mathematical business cycle models developed by Ragnar Frisch, Michal Kalecki, Jan Tinbergen and others, which were presented at meetings of the Econometric Society and discussed in private correspondence. By doing so, it demonstrates the diversity of models representing economic phenomena and especially economic crises and instability. Jan Tinbergen emerged as one of the most original and pivotal economists of this period, before becoming a leader of the macro-econometric movement, a role for which he is better known. His emphasis on economic policy was later mirrored in the United States in Paul Samuelson’s early work on business cycles analysis, which, drawing on Alvin Hansen, aimed at interpreting the 1937-1938 recession. The authors then show that the subsequent shift in Samuelson's approach, from the study of business cycle trajectories to the comparison of equilibrium points, provided a response to the econometricians' critique of early Keynesian models. In the early 1940s, Samuelson was able to link together the tools that had been developed by the econometricians and the economic content that was at the heart of the so-called Keynesian revolution. The problem then shifted from business cycle trajectories to the disequilibrium between economic aggregates, and the issues raised by the global stability of full employment equilibrium. This was addressed by Oskar Lange, who presented an analysis of market coordination failures, and Lawrence Klein, Samuelson's first PhD student, who pursued empirical work in this direction. The book highlights the various visions and approaches that were embedded in these macro-dynamic models, and that their originality is of interest to today's model builders as well as to students and anyone interested in how new economic ideas come to be developed.

Modeling Energy-Economy Interactions: Five Appoaches (Routledge Revivals)

by Charles J. HitchThis report, first published in 1977, explores several different approaches to the same question; namely, how severe will be the impact on key U.S. macro-economic variables of the transition from main reliance on oil and natural gas to other sources of energy? This book will be of interest to students of economics and environmental studies.

Modeling Environment-Improving Technological Innovations under Uncertainty (Routledge Explorations in Environmental Economics)

by Anil Markandya Alexander A. GolubThe issues of technology and uncertainty are very much at the heart of the policy debate of how much to control greenhouse gas emissions. The costs of doing so are present and high while the benefits are very much in the future and, most importantly, they are highly uncertain. Whilst there is broad consensus on the key elements of climate change science and agreement that near-term actions are needed to prevent dangerous anthropogenic interference with the climate system, there is little agreement on the costs and benefits of climate policy. The book looks at different ways of reconciling the needs for sustainability and equity with the costs of action now. Presenting a compendium of methodologies for evaluating the economic impact of technological innovation upon climate-change policy, this book describes mathematical models and their predictions. The goal is to provide a practitioner’s guide for doing the science of economics and climate change. Because the assumptions motivating different problems in the economics of climate change have different complexities, a number of models are presented with varying levels of difficulty: reduced-form and structural, partial- and general-equilibrium, closed-form and computational. A unifying theme of these models is the incorporation of a number of price and quantity instruments and an analysis of their respective efficacies. This book presents models that contain structural uncertainty, i.e., uncertainty that economic agents respond to via their risk attitudes. The novelty of this book is to relate the effects of risk and risk attitudes to environment-improving technological innovation.