- Table View

- List View

The Data Governance Imperative: A Business Strategy for Corporate Data

by Steve SarsfieldAttention to corporate information has never been more important than now. The ability to generate accurate business intelligence, accurate financial reports and to understand your business relies on better processes and personal commitment to clean data. Every byte of data that resides inside your company, and some that resides outside its walls, has the potential to make you stronger by giving you the agility, speed and intelligence that none of your competitors yet have. Data governance is the term given to changing the hearts and minds of your company to see the value of such information quality. "The Data Governance Imperative" is a business person's view of data governance. This practical book covers both strategies and tactics around managing a data governance initiative. The author, Steve Sarsfield, works for a major enterprise software company and is a leading expert in data quality and data governance, focusing on the business perspectives that are important to data champions, front-office employees, and executives.

The Data Preparation Journey: Finding Your Way with R (Chapman & Hall/CRC Data Science Series)

by Martin Hugh MonkmanThe Data Preparation Journey: Finding Your Way With R introduces the principles of data preparation within in a systematic approach that follows a typical data science or statistical workflow. With that context, readers will work through practical solutions to resolving problems in data using the statistical and data science programming language R. These solutions include examples of complex real-world data, adding greater context and exposing the reader to greater technical challenges. This book focuses on the Import to Tidy to Transform steps. It demonstrates how “Visualise” is an important part of Exploratory Data Analysis, a strategy for identifying potential problems with the data prior to cleaning.This book is designed for readers with a working knowledge of data manipulation functions in R or other programming languages. It is suitable for academics for whom analyzing data is crucial, businesses who make decisions based on the insights gleaned from collecting data from customer interactions, and public servants who use data to inform policy and program decisions. The principles and practices described within The Data Preparation Journey apply regardless of the context.Key Features: Includes R package containing the code and data sets used in the book Comprehensive examples of data preparation from a variety of disciplines Defines the key principles of data preparation, from access to publication

The Data-Driven Project Manager: A Statistical Battle Against Project Obstacles

by Mario VanhouckeDiscover solutions to common obstacles faced by project managers. Written as a business novel, the book is highly interactive, allowing readers to participate and consider options at each stage of a project. The book is based on years of experience, both through the author's research projects as well as his teaching lectures at business schools.The book tells the story of Emily Reed and her colleagues who are in charge of the management of a new tennis stadium project. The CEO of the company, Jacob Mitchell, is planning to install a new data-driven project management methodology as a decision support tool for all upcoming projects. He challenges Emily and her team to start a journey in exploring project data to fight against unexpected project obstacles.Data-driven project management is known in the academic literature as “dynamic scheduling” or “integrated project management and control.” It is a project management methodology to plan, monitor, and control projects in progress in order to deliver them on time and within budget to the client. Its main focus is on the integration of three crucial aspects, as follows:Baseline Scheduling: Plan the project activities to create a project timetable with time and budget restrictions. Determine start and finish times of each project activity within the activity network and resource constraints. Know the expected timing of the work to be done as well as an expected impact on the project’s time and budget objectives. Schedule Risk Analysis: Analyze the risk of the baseline schedule and its impact on the project’s time and budget. Use Monte Carlo simulations to assess the risk of the baseline schedule and to forecast the impact of time and budget deviations on the project objectives. Project Control: Measure and analyze the project’s performance data and take actions to bring the project on track. Monitor deviations from the expected project progress and control performance in order to facilitate the decision-making process in case corrective actions are needed to bring projects back on track. Both traditional Earned Value Management (EVM) and the novel Earned Schedule (ES) methods are used.What You'll LearnImplement a data-driven project management methodology (also known as "dynamic scheduling") which allows project managers to plan, monitor, and control projects while delivering them on time and within budgetStudy different project management tools and techniques, such as PERT/CPM, schedule risk analysis (SRA), resource buffering, and earned value management (EVM)Understand the three aspects of dynamic scheduling: baseline scheduling, schedule risk analysis, and project controlWho This Book Is ForProject managers looking to learn data-driven project management (or "dynamic scheduling") via a novel, demonstrating real-time simulations of how project managers can solve common project obstacles

The Data-driven Organization: Using Data for the Success of Your Company (Business Guides on the Go)

by Jonas RashediData has become an indispensable success factor for every company. However, the road towards a data-driven organization is paved with numerous challenges. This book presents a process model for the path to a data-driven company and provides recommendations for the design of all relevant fields of action: Which structures need to be created? Which systems and processes have proven beneficial? How can the quality of the data be ensured and what requirements exist for a data-driven organization in the areas of governance and communication? And last but not least: How can employees be brought along on the journey and what implications does the data-driven organization have for our corporate culture? The book presents an orientation and action framework for the strategic and operational design of a data-driven organization and is valuable for managers who are involved in data management in companies and organizations.

The Datapreneurs: The Promise of AI and the Creators Building Our Future

by Steve Hamm Bob MugliaA leader in the data economy explains how we arrived at AI—and how we can navigate its future In The Datapreneurs, Bob Muglia helps us understand how innovation in data and information technology have led us to AI—and how this technology must shape our future. The long-time Microsoft executive, former CEO of Snowflake, and current tech investor maps the evolution of the modern data stack and how it has helped build today&’s economy and society. And he explains how humanity must create a new social contract for the artificial general intelligence (AGI)—autonomous machines intelligent as people—that he expects to arrive in less than a decade. Muglia details his personal experience in the foundational years of computing and data analytics, including with Bill Gates and Sam Altman, the CEO of OpenAI, the creator of ChatGPT, and others that are not household names—yet. He builds upon Isaac Asimov&’s Laws of Robotics to explore the moral, ethical, and legal implications of today&’s smart machines, and how a combination of human and machine intelligence could create an era of progress and prosperity where all the people on Earth can have what they need and want without destroying our natural environment.The Datapreneurs is a call to action. AGI is surely coming. Muglia believes that tech business leaders, ethicists, policy leaders, and even the general public must collaborate answer the short- and long-term questions raised by its emergence. And he argues that we had better get going, because advances are coming so fast that society risks getting caught flatfooted—with potentially disastrous consequences.

The Dawn of Industrial Agriculture in Iowa: Anthropology, Literature, and History

by E. Paul DurrenbergerIn The Dawn of Industrial Agriculture in Iowa E. Paul Durrenberger recounts the transformation of Iowa’s family farms into today’s agricultural industry through the lens of the lives and writings of Iowa novelist Paul Corey and poet Ruth Lechlitner. This anthropological biography analyzes Corey’s fiction, Lechlitner’s poetry, and their professional and personal correspondence to offer a new perspective on an era (1925–1947) that saw the collapse and remaking of capitalism in the United States, the rise of communism in the Soviet Union, the rise and defeat of fascism around the world, and the creation of a continuous warfare state in America. Durrenberger tells the story that Corey aimed to record and preserve of the industrialization of Iowa’s agriculture and the death of its family farms. He analyzes Corey’s regionalist focus on Iowa farming and regionalism’s contemporaneous association in Europe with rising fascism. He explores Corey’s adoption of naturalism, evident in his resistance to heroes and villains, to plot structure and resolution, and to moral judgment, as well as his ethnographic tendency to focus on groups rather than individuals. An unusual and wide-ranging study, The Dawn of Industrial Agriculture in Iowa offers important insight into the relationships among fiction, individual lives, and anthropological practice, as well as into a pivotal period in American history.

The Dawn of Innovation: The First American Industrial Revolution

by Charles R. MorrisIn the thirty years after the Civil War, the United States blew by Great Britain to become the greatest economic power in world history. That is a well-known period in history, when titans like Andrew Carnegie, John D. Rockefeller, and J. P. Morgan walked the earth. But as Charles R. Morris shows us, the platform for that spectacular growth spurt was built in the first half of the century. By the 1820s, America was already the world's most productive manufacturer, and the most intensely commercialized society in history. The War of 1812 jumpstarted the great New England cotton mills, the iron centers in Connecticut and Pennsylvania, and the forges around the Great Lakes. In the decade after the War, the Midwest was opened by entrepreneurs. In this beautifully illustrated book, Morris paints a vivid panorama of a new nation buzzing with the work of creation. He also points out the parallels and differences in the nineteenth century American/British standoff and that between China and America today.

The Dawn of the Pacific Century: Implications For Three Worlds Of Development

by William McCordThis book is a bold affirmation of the Asian 'miracle' of development, an explanation of reasons for its success, and a review of its implications. As McCord reminds us, understanding why and how these nations have propelled themselves so far, so fast, is a key to anticipating the destiny of much of the rest of the world. Despite their interest, analysis have been confounded in attempts to explain Asian Development-without resources and colonies, without internal violence, and broadly distributing wealth as they have grown. Existing theories of development offer little guidance. Even explanations that look to the special circumstances of Asian countries have their weaknesses. Reviewing all of these explanations, McCord identifies a common group of socioeconomic values and policies shared by most of these nations. And these, he shows, tell us much. The Dawn of the Pacific Century convincingly makes the case for a genuinely Asian model of development-one that must be understood on its own terms. It should find a broad professional social science readership. In addition, those general readers who wish to learn from and understand the Asian challenge will find this book a good beginning.

The Day After Tomorrow: A Handbook on the Future of Economic Policy in the Developing World

by Marcelo M. Giugale Otaviano CanutoThe 2008-09 Global Financial Crisis shook the ground under the conventional wisdom that had guided mainstream development economics. Much of what had been held as true for decades is now open to reexamination-from what the role of governments should be in markets to which countries will be the engines of the world's economy, from what people need to leave poverty to what businesses need to stay competitive. Development economists look into the future. They do not just ask how things work today, but how a new policy, program, or project would make them work tomorrow. They view the world and history as a learning process-past and present are inputs into thinking about what is coming. It is that appetite for a vision of the future that led the authors of 'The Day after Tomorrow: A Handbook on the Future of Economic Policy in the Developing World' to invite some 40 development economists, most of them from the World Bank's Poverty Reduction and Economic Management Network-an epicenter of the profession-to report what they see on the horizon of their technical disciplines and of their geographic areas of specialization. The disconcerting but exciting search for a new intellectual compact has begun. To help guide the discussion, 'The Day after Tomorrow: A Handbook on the Future of Economic Policy in the Developing World' puts forth four key messages: While the developed world gets its house in order, and macroeconomics and finance achieve a new consensus, developing countries will become a (perhaps the) growth engine for the world. Faster technological learning and more South-South integration will fuel that engine. Governments in developing countries will be better-they may even begin to earn the trust of their people. A new, smarter generation of social policy will bring the end of poverty within reach, but the attainment of equality is another matter. Many regions of the developing world will break out of their "developing" status and will graduate into something akin to "newly developed." Africa will eventually join that group. Others, like Eastern Europe, have a legacy of problems to address before such a transition. While some regions will do better than others, and some technical areas will be clearer than others, there is no question that the horizon of economic policy for developing countries is promising-risky, yes, but promising. The rebalancing of global growth toward, at the very least, a multiplicity of engines, will give the developing world a new relevance.

The Day After the Dollar Crashes: A Survival Guide for the Rise of the New World Order

by Damon VickersHow to profit from the events leading up to the likely collapse of the U.S. dollar Society is at a crossroads. Here at home and around the world, we are living in a manner that is absolutely, unconditionally, irrevocably unsustainable. The Day After the Dollar Crashes: A Survival Guide for the Rise of the New World Order outlines the kinds of events that could trigger a global economic collapse, describing in detail the events that are likely to occur just prior to, during, and immediately following such a total collapse. It also explains how investors can profit and support a sustainable future by anticipating social trends. Describes what government can do now to soften the dollar's fall later Details how to lead the charge to introduce innovations and solutions to meet the inevitable challenges of new kinds of economic forces Reveals how to profit by changing expectations and taking action to align investments with reality The Day After the Dollar Crashes tears away the illusions generated by politicians, media, and the financial industry to show how investors can position themselves to survive and thrive in a New World Order.

The Day It Finally Happens: Alien Contact, Dinosaur Parks, Immortal Humans - And Other Possible Phenomena

by Mike Pearl__________If you live on planet Earth, you're probably scared about the future.Terrorism, complicated international relations, global warming, killer viruses and a raft of other issues make it hard not to be.Watching the news you have to wonder: is it safe to go out there or not?In The Day It Finally Happens, Mike Pearl games out many of the 'could it really happen?' scenarios we've all speculated about, assigning a probability rating, and taking us through how it would unfold. He explores what would likely occur in dozens of possible scenarios - the final failure of antibiotics, the loss of the world's marine life, the abolition of the British monarchy, and even the arrival of aliens - and reports back from the future, providing a clear picture on how the world would look, feel, and even smell in each of these instances.Hilarious, enlightening, and terrifying, this book makes science accessible and is a unique form of existential therapy, offering practical answers to some of our most worrisome questions.Thankfully, the odds of humanity pulling through look pretty good.__________For fans of such bestsellers as What If?,The Worst Case Scenario Survival Handbook and The Uninhabitable Earth, as well as Steven Pinker and Malcolm Gladwell, this is a book about future events that we don't really understand and getting to know them in close detail.Entertaining speculation featuring both authoritative research and a bit of mischief: a look at how humanity is likely to weather such happenings as the day nuclear war occurs, the day the global internet goes down, the day we run out of effective antibiotics, and the day immortality is achieved.

The Day It Finally Happens: Alien Contact, Dinosaur Parks, Immortal Humans - And Other Possible Phenomena

by Mike Pearl__________If you live on planet Earth, you're probably scared about the future. Terrorism, complicated international relations, global warming, and a raft of other issues make it hard not to be. Watching the news you have to wonder: is it safe to go out there or not? In The Day It Finally Happens, Mike Pearl games out many of the 'could it really happen?' scenarios we've all speculated about, assigning a probability rating, and taking us through how it would unfold. He explores what would likely occur in dozens of possible scenarios - the final failure of antibiotics, the loss of the world's marine life, the abolition of the British monarchy, and even the arrival of aliens - and reports back from the future, providing a clear picture on how the world would look, feel, and even smell in each of these instances. Hilarious, enlightening, and terrifying, this book makes science accessible and is a unique form of existential therapy, offering practical answers to some of our most worrisome questions. Thankfully, the odds of humanity pulling through look pretty good. __________For fans of such bestsellers as What If?,The Worst Case Scenario Survival Handbook and The Uninhabitable Earth, as well as Steven Pinker and Malcolm Gladwell, this is a book about future events that we don't really understand and getting to know them in close detail. Entertaining speculation featuring both authoritative research and a bit of mischief: a look at how humanity is likely to weather such happenings as the day nuclear war occurs, the day the global internet goes down, the day we run out of effective antibiotics, and the day immortality is achieved.(P) 2019 Simon & Schuster Audio

The Day the King Defaulted: Financial Lessons from the Stop of the Exchequer in 1672

by Moshe Arye MilevskyThis book studies King Charles II's decision to stop all payments from his royal exchequer, a sordid but little-known event in English history with eerie similarities to the cause of the Great Recession of 2008. As with any modern banking crisis, the financial system in 1672 almost collapsed, day-to-day commerce ground to a halt, houses were lost, and ordinary investors suffered—but there was no banking bailout, and no mercy for the goldsmith-bankers who had lent the king millions to fund his unsustainable lifestyle. The royal decision, made in the wake of plagues, fires, and war with the Dutch, left bankers unable to cover their own liabilities and, in the days before bankruptcy, they couldn’t walk away from their obligations and start fresh. Many bankers spent the end of their lives in debtors' prison, but English commoners had little sympathy for the plight of rich financiers—a sentiment echoed after the financial crisis of 2008. Ultimately, this book tells the complete story of the Merry Monarch's financial default (England's first and last) using the lens and language of modern financial products and markets. It covers the precarious history leading up to the infamous day in 1672, the intrigue surrounding the ‘stop’—including those who traded on inside information beforehand—and the attempt by distressed creditors to gain financial restitution.

The Day the Markets Roared: How a 1982 Forecast Sparked a Global Bull Market

by Henry Kaufman David B. SiciliaLegendary economist Dr. Henry Kaufman shares a classic Wall Street story that has never been fully told: a firsthand account of the day in August 1982 that would define US economics for decades Dr. Henry Kaufman is the most famous economist Wall Street has ever seen, renowned well beyond the financial industry. He was the subject of New Yorker cartoons, had cameos in drama productions and two seminal literary works of the 1980s, was subject to death threats, and enjoyed the nickname "Dr. Doom." His pinnacle of influence arrived on August 17, 1982. That single day turned out to be the beginning of the world that we now live in. At the time, after painful years of high interest rates and the inflation of the late 1960s and 1970s, consumers were paying 17 percent and higher to borrow money. But by the end of one summer day almost 40 years ago, the stock market had undergone its second-biggest rally since WWII, while bond prices soared and interest rates plunged. Dr. Kaufman himself had written a memo that sparked this tremendous boom-and it set the global markets on fire, marking the start of almost four decades of US economic growth. The Day the Markets Roared answers the questions: Why did Dr. Kaufman break with his longstanding bearish views to make a momentous prediction that spurred blaring headlines everywhere from Brazil to Beijing? How could a private individual exercise such profound influence over global financial markets? How did we get to today's rock-bottom and even negative rates? And what is their continuing impact on the economy, our financial markets and our livelihoods? The Day the Markets Roared is a firsthand, minute-by-minute account of one remarkable day in financial and economic history, with a rich cast of characters, from Salomon's John Gutfreund to interest rate guru Sydney Homer, to Dr. Kaufman's longtime friend, Fed Chairman Paul Volcker. Dr. Kaufman reflects on the lessons of the historic August 1982 episode, harkening back to a more optimistic moment in American history, and offering inspiration for better times ahead.

The Day the World Stops Shopping: How Ending Consumerism Saves The Environment And Ourselves

by J.B. MackinnonIn a brilliant work of imaginative non-fiction, prize-winning author J.B. MacKinnon asks what would happen--to our economy, our ecology, our products, our selves--if we stopped consuming so much? Is that alternative world one we might actually want to live in?"We can't stop shopping. And yet we must. This is the consumer dilemma." The planet says we consume too much: in North America, we burn the earth's resources at a rate five times faster than they can regenerate. And despite our efforts to "green" our consumption--by recycling, increasing energy efficiency, or using solar power--we have yet to see a decline in global carbon emissions. The economy says we must always consume more, because, as we've seen in the pandemic, even the slightest drop in spending leads to widespread unemployment, bankruptcy and home foreclosures. Addressing this paradox head-on, J.B. MacKinnon asks, What would really happen if we simply stop shopping? Is there a way to reduce our consumption to earth-saving levels without triggering an economic collapse? At first, this question took him around the world, seeking answers: from America's big-box stores, to the hunter-gatherer cultures of Namibia, to communities in Ecuador that consume at an exactly sustainable rate. Then his thought experiment came shockingly true, as the coronavirus brought shopping to a halt and MacKinnon's ideas were tested in real time. Drawing on experts ranging from economists to climate scientists to corporate CEOs, MacKinnon investigates how living with less would change our planet, our society and ourselves. Along the way, he reveals just how much we stand to gain. Imaginative and inspiring, The Day the World Stops Shopping will empower you to imagine another way.

The Day the World Took Off: The Roots of the Industrial Revolution

by Sally Dugan David DuganBased on the arguments of internationally acclaimed academics coupled with craftsmen's demonstrations, this book makes use of original machines, diaries and first-hand accounts to provide a long-term history of the social, economic and intellectual developments which have shaped the differential development of the modern world.

The De Beers Group: Exploring the Diamond Reselling Opportunity

by Benjamin C. Esty Lauren G. Pickle Daniel P. GrossIn September 2014, Tom Montgomery (SVP of strategic initiatives at the De Beers Group) and his team launched a pilot program in the United States to explore the $1 billion diamond market for pre-owned (recycled) diamonds. According to Montgomery, the motivation for the pilot program was to improve the consumer reselling experience and to enhance "diamond equity". Somewhat paradoxically, consumers typically received very low prices when they tried to sell diamonds (5-20% of the original retail price) leaving them reluctant to purchase diamonds in the future and making them into ambassadors of ill will. At a meeting scheduled for November 2015, the De Beers Executive Committee would have to decide whether to end the pilot program, extend it for another year to gather more information, or convert it into a new standalone business unit. Because De Beers had historically focused on producing rough diamonds (the "upstream" business), yet the new business unit offered an opportunity to enter and enhance the market for polished diamonds (the "downstream" business), the decision was particularly noteworthy.

The De Beers Group: Exploring the Diamond Reselling Opportunity

by Benjamin C. Esty Lauren G. Pickle Daniel P. GrossIn September 2014, Tom Montgomery (SVP of strategic initiatives at the De Beers Group) and his team launched a pilot program in the United States to explore the $1 billion diamond market for pre-owned (recycled) diamonds. According to Montgomery, the motivation for the pilot program was to improve the consumer reselling experience and to enhance "diamond equity". Somewhat paradoxically, consumers typically received very low prices when they tried to sell diamonds (5-20% of the original retail price) leaving them reluctant to purchase diamonds in the future and making them into ambassadors of ill will. At a meeting scheduled for November 2015, the De Beers Executive Committee would have to decide whether to end the pilot program, extend it for another year to gather more information, or convert it into a new standalone business unit. Because De Beers had historically focused on producing rough diamonds (the "upstream" business), yet the new business unit offered an opportunity to enter and enhance the market for polished diamonds (the "downstream" business), the decision was particularly noteworthy.

The De Beers Group: Launching GemFair for Artisanal Diamonds

by Daniel Fisher Benjamin C. EstyIn May 2018, the De Beers Group shocked the diamond industry when it announced it was launching a new fashion jewelry brand of laboratory-grown (synthetic) diamonds. The reaction was swift as people sought to understand the company's motivations: was it a "huge gamble" or a "Machiavellian masterstroke"? What was the objective of the new product launch, would it succeed, and how would this new business affect the Group's core business of selling natural (mined) diamonds? This case is intended to be used in conjunction with and to follow a related HBS case: The De Beers Group: Exploring the Diamond Reselling Opportunity (HBS #717-430). <p><p> This case illustrates the process of strategy development at one of the world's most iconic brands (De Beers). Along with the Diamond Reselling case, it illustrates how companies can use exploration and experimentation to develop positions in new markets. Within the diamond industry, it shows an attempt to differentiate products (the market for natural vs. synthetic diamonds) and to defend a core market by commoditizing a potential threat. Finally, it illustrates Bain & Company's strategic concept of using "adjacent" markets to achieve incremental growth and profitability above and beyond a firm's core market (see Zook and Allen, HBR 2003).

The De Beers Group: Launching Lightbox Jewelry for Lab-Grown Diamonds

by Benjamin C. EstyIn May 2018, the De Beers Group shocked the diamond industry when it announced it was launching a new fashion jewelry brand of laboratory-grown (synthetic) diamonds. The reaction was swift as people sought to understand the company's motivations: was it a "huge gamble" or a "Machiavellian masterstroke"? What was the objective of the new product launch, would it succeed, and how would this new business affect the Group's core business of selling natural (mined) diamonds? This case is intended to be used in conjunction with and to follow a related HBS case: The De Beers Group: Exploring the Diamond Reselling Opportunity (HBS #717-430). <p><p> This case illustrates the process of strategy development at one of the world's most iconic brands (De Beers). Along with the Diamond Reselling case, it illustrates how companies can use exploration and experimentation to develop positions in new markets. Within the diamond industry, it shows an attempt to differentiate products (the market for natural vs. synthetic diamonds) and to defend a core market by commoditizing a potential threat. Finally, it illustrates Bain & Company's strategic concept of using "adjacent" markets to achieve incremental growth and profitability above and beyond a firm's core market (see Zook and Allen, HBR 2003).

The Dead Pledge: The Origins of the Mortgage Market and Federal Bailouts, 1913–1939 (Columbia Studies in the History of U.S. Capitalism)

by Judge Earl GlockThe American government today supports a financial system based on mortgage lending, and it often bails out the financial institutions making these mortgages. The Dead Pledge reveals the surprising origins of American mortgages and American bailouts in policies dating back to the early twentieth century.Judge Glock shows that the federal government began subsidizing mortgages in order to help lagging sectors of the economy, such as farming and construction. In order to encourage mortgage lending, the government also extended unprecedented assistance to banks. During the Great Depression, the federal government made new mortgage lending and bank bailouts the centerpiece of its recovery program. Both the Herbert Hoover and Franklin Roosevelt administrations created semipublic financial institutions, such as Fannie Mae, to provide cheap, tradable mortgages, and they extended guarantees to more banks and financiers. Ultimately, Glock argues, the desire to protect the financial system took precedence over the desire to help lagging parts of the economy, and the government became ever more tied into the financial world.The Dead Pledge recasts twentieth-century economic, financial, and political history and demonstrates why the greatest “safety net” created in this era was the one supporting finance.

The Deadline Effect

by Christopher Cox'I love deadlines. I like the whooshing sound they make as they fly by.' So said author Douglas Adams - but what if there was a way of making deadlines work for you and using them to ensure others provide you with what you want when you want it? In Christopher Cox's brilliant new book, he looks at the impact deadlines have on us, and how we can use them to deliver the best results for all parties. Social scientists have revealed that most negotiations run right up to the deadline before a deal is finally struck. What they also discovered was that this deadline effect usually results in a worse deal for both parties. Cox shows you how, instead, the deadline effect can be used to bring about success not failure. The truth is that most of us think of deadlines all wrong. They aren&’t immutable laws of nature; they are a game we can play - and win. This book will show you the strategies different workplaces have come up with to do just that. They are the businesses and individuals who are rehabilitating the deadline effect, taking the urgency it provides and jettisoning all the down-to-the-wire nonsense. Based on his own experience as a magazine commissioning editor, where coaxing writers to deliver on time is an art form, he also embeds himself in other businesses, such as a ski patrol ahead of the first day of the winter season, to see how they meet deadlines that cannot be missed. Above all, this book is an argument to embrace the power of deadlines. When time is limited, people are less wasteful, more focused, productive and creative. It&’s a liberating realisation: excellence and timeliness are not at odds, and the deadline effect can be highly effective.

The Deadline Effect: How to Work Like It's the Last Minute—Before the Last Minute

by Christopher CoxIn the tradition of Charles Duhigg&’s The Power of Habit, Christopher Cox&’s The Deadline Effect is a wise and counterintuitive book that explores the power of deadlines as uniquely effective tools of motivation and empowerment.Perfectionists and procrastinators alike agree—it&’s natural to dread a deadline. Whether your goal is to complete a masterpiece or just check off an overwhelming to-do list, the ticking clock signals despair. Christopher Cox knows the panic of the looming deadline all too well—as a magazine editor, he has spent years overseeing writers and journalists who couldn&’t meet a deadline to save their lives. After putting in a few too many late nights in the newsroom, he became determined to learn the secret of managing deadlines. He set off to observe nine different organizations as they approached a high-pressure deadline. Along the way, Cox made an ever greater discovery: these experts didn&’t just meet their big deadlines—they became more focused, productive, and creative in the process. In The Deadline Effect, Cox shares the strategies these teams used to guarantee success while staying on schedule: a restaurant opening for the first time, a ski resort covering an entire mountain in snow, a farm growing enough lilies in time for Easter, and more. Cox explains how readers can understand the psychological underpinnings of expectations and time, the dynamics of teams and customers, and techniques for using deadlines to make better, more assured decisions.

The Deal Paradox: Mergers and Acquisitions Success in the Age of Digital Transformation

by Michel Driessen Dr Anna Faelten Professor Scott MoellerThe Deal Paradox explores what successful dealmaking looks like in the age of digital transformation, drawing on interviews with top dealmakers and M&A experts sharing their stories, triumphs, and challenges.Taking a dynamic storytelling approach, The Deal Paradox navigates the transition from traditional and ingrained methods to new techniques, showing how AI, big data, and machine learning can be used to generate new opportunities and enable diversity. It walks through the attributes and skills needed in this new landscape and how M&A professionals can build them into their approach, from finding and executing deals to making sure they deliver the desired outcomes.The Deal Paradox draws on 60 years' combined experience of cutting-edge deal making, built on landmark deals ranging from Morgan Stanley's IPO at the height of the 1980s banking boom and Kraft's takeover of Cadbury to key tech deals including the £1bn sale of financial data intelligence company Acuris to ION. Chapters are richly illustrated throughout with real-world examples featuring organizations such as Apple, Google, BP and SoftBank Vision Fund.

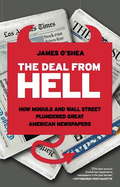

The Deal from Hell: How Moguls and Wall Street Plundered Great American Newspapers

by James O'SheaIn 2000, after the Tribune Company acquired Times Mirror Corporation, it comprised the most powerful collection of newspapers in the world. How then did Tribune nosedive into bankruptcy and public scandal? In The Deal From Hell, veteran Tribune and Los Angeles Times editor James O'Shea takes us behind the scenes of the decisions that led to disaster in boardrooms and newsrooms from coast to coast, based on access to key players, court testimony, and sworn depositions.The Deal From Hell is a riveting narrative that chronicles how news industry executives and editors--convinced they were acting in the best interests of their publications--made a series of flawed decisions that endangered journalistic credibility and drove the newspapers, already confronting a perfect storm of political, technological, economic, and social turmoil, to the brink of extinction.