- Table View

- List View

The Mystery at Stormy Point (Seaview Stables Adventures #2)

by Tracey CorderoyJoin Bryony and Red on another Seaview Stables adventure from bestselling author, Tracey Corderoy! Bryony has settled into life at Brook Dale, especially now she&’s the owner of her dream pony Red! And with the whole town gearing up for the Three Coves Gymkhana, there&’s plenty to keep her and her new friends busy. Bryony can&’t wait to show everyone just how brilliant Red is, especially her former enemy Georgina Brook. Then, one day, while practising for the gymkhana, she notices a strange light coming from the disused lighthouse at Stormy Point. The lighthouse has been empty for years and Bryony is determined to find out just who – or what – is living there… Will Bryony get to the bottom of the mystery? And just how far will Georgina go to destroy Bryony&’s gymkhana dreams…

The False Fairy: The Bard And The Beast; The Pegasus Quest; The False Fairy; The Sorcerer's Shadow (The Kingdom of Wrenly #11)

by Jordan QuinnIn the eleventh fantastical adventure of The Kingdom of Wrenly series, a spell makes all but one fairy disappear.A mysterious spell has hypnotized the fairies on the island of Primlox and now it is up to Prince Lucas and Clara for save the fairyland. Along with the last remaining fairy named Falsk, will the two friends find the missing fairies? Or is Falsk, who is famous for telling wild stories, leading Lucas and Clara into a trap?With easy-to-read language and illustrations on almost every page, The Kingdom of Wrenly chapter books are perfect for beginning readers.

Laughing in the Dark: A Comedian's Journey through Depression

by Chonda PierceA refreshingly honest and witty exploration of one woman&’s journey through depression. For many, depression is associated with shame and humiliation—even a lack of faith. But Laughing in the Dark is like getting genuine advice from a kind friend. And in her words you&’ll find hope and renewed confidence that will guide you through your own darkness and into the light.- If you are currently suffering from depression—this book will help you realize you&’re not alone. - If you have a loved one dealing with depression—this book will help you understand. - If you are a mental health professional—you now have a new tool to encourage your clients.Along with the humor, Chonda Pierce shares practical insight, biblical teaching, emotional support, and sympathetic concern. Whether you&’ve experienced depression in your own life or in the life of someone you love, this friend has something to offer you: help, hope and, believe it or not, plenty of laughter.

The Idea of Decline in Western History

by Arthur HermanHistorian Arthur Herman traces the roots of declinism and shows how major thinkers, past and present, have contributed to its development as a coherent ideology of cultural pessimism.From Nazism to the Sixties counterculture, from Britain's Fabian socialists to America's multiculturalists, and from Dracula and Freud to Robert Bly and Madonna, this work examines the idea of decline in Western history and sets out to explain how the conviction of civilization's inevitable end has become a fixed part of the modern Western imagination. Through a series of biographical portraits spanning the 19th and 20th centuries, the author traces the roots of declinism and aims to show how major thinkers of the past and present, including Nietzsche, DuBois, Sartre, and Foucault, have contributed to its development as a coherent ideology of cultural pessimism.

Danger Close: My Epic Journey as a Combat Helicopter Pilot in Iraq and Afghanistan

by Amber SmithInspiring and “riveting…vivid and harrowing” (Sean Parnell, author of Outlaw Platoon), Danger Close is the first memoir of active combat by a female helicopter pilot in Iraq and Afghanistan. New York Times bestselling author Brad Thor raves, “Men and women alike will love this incredible tale of heroism, humility, and high-octane feats of bravery.”Amber Smith flew into enemy fire in some of the most dangerous combat zones in the world. One of only a few women to fly the Kiowa Warrior helicopter—whose mission, armed reconnaissance, required its pilots to stay low and fly fast, perilously close to the fight—Smith deployed to Iraq and Afghanistan and rose to Pilot-in-Command and Air Mission Commander in the premier Kiowa unit in the Army. She learned how to perform and survive under extreme pressure, both in action against an implacable enemy and within the elite “boy’s club” of Army aviation.In Danger Close, Smith “covers each mission with edge-of-your-seat detail and a coolness that demonstrates how she gained the respect of fellow pilots and soldiers on the ground” (Library Journal). Smith’s unrelenting fight for both mastery and respect delivers universal life-lessons that will be useful to any civilian, from “earning your spurs” as a newbie to “embracing the suck” through setbacks that challenge your self-confidence to learning to trust your gut as a veteran of your profession.Intensely personal, cinematic, poignant, and inspiring, Danger Close is “the captivating story of one woman’s fight to serve her country in the direct line of danger” (Dana Perino, co-host of The Five on Fox News).

The Politics of Public Fund Investing: How to Modify Wall Street to Fit Main Street

by Ben FinkelsteinUntil now, there has never been a book to help public fund managers direct fixed-income portfolios while simultaneously balancing politics, or the need to preserve principal, with economics, or the need to optimize income. The Politics of Public Fund Investing approaches public fund management from the lay perspective, providing much-needed guidance to modify Wall Street strategies to serve the needs of Main Street. If you manage a public fund, if you are an elected official, or if you oversee a portfolio for a foundation or an endowment, you know the traditional money management strategy used every day on Wall Street doesn't necessarily apply to your situation. For you, investing isn't simply about economics. Wall Street strategies do not take into account election cycles, political risk factors, or the unique performance assessments public funds must undergo. When Wall Street builds a portfolio, it doesn't need to consider the opinions and desires of a wide variety of constituents, and the management of the portfolio's performance doesn't carry the same level of career risk. This groundbreaking book is the first resource ever available to the stewards of public fund investing entrusted with the responsibility to make financial decisions in this unique environment. The Politics of Public Fund Investing shows readers how to evaluate and measure their funds' performance through specific techniques, standards, and procedures. It begins by addressing the key differences between Wall Street and Main Street, explaining which methods of Wall Street are unsuited to public fund management and why. The book provides a framework for moving from a static investment policy to a dynamic investment plan, making the important distinction between what is "legal" in terms of policy and what is "suitable" in terms of the objectives of the stakeholders. The book goes on to propose exceptional and beneficial insights into appraising a fund's performance along with providing a four-step process to build a politically correct portfolio. Finally, it shows how to be safe and optimize income within the constraints of acceptable risk. Based on years of experience and invaluable research, The Politics of Public Fund Investing is an innovative, compelling, and much-needed guide to navigating the complex territory where the political environment meets public investing.

The Monster Squad (Junior Monster Scouts #1)

by Joe McGeeGet to know the Junior Monster Scouts in this first book in a brand-new chapter book series that&’s perfect for fans of Desmond Cole Ghost Patrol and Hotel Transylvania!Wolfy, Franky, and Vampyra—the children of the classic monsters—are Junior Monster Scouts. And even though &‘monster&’ is their middle name, these funny fiends just want to help anybody in need, earn their Junior Monster Scout merit badges, and make friends. But, their good deeds are always foiled by Baron Von Grump, a cranky schemer who doesn&’t like noise, doesn&’t like kids, and most of all doesn&’t like the Junior Monster Scouts.Peter Piper&’s kitten Shadow is lost deep in The Gloomy Forest, and the Scouts want to help their new friend. But today is also the Village Cheese Festival and all of the celebrating has Baron Von Grump at wits&’ end. How can he play his violin in peace if the villagers are making such a racket? He hatches a cheesy plan that involves huge and hungry rats! Uh-oh! Can the Scouts save the cats, the rats, and the day?

The Homebrewers' Recipe Guide: More Than 175 Original Beer Recipes Including Magnificent Pale Ales, Ambers, Stouts, Lagers, And Seasonal Brews, Plus Tips From The Master Brewers

by Patrick Higgins Maura Kate Kilgore Paul HertleinGreat beers to make at home, including more than 175 original beer recipes ranging from magnificent pale ales to ambers, stouts, lagers, and seasonal brews, plus tips from master brewers.If you’re into homebrewing, then you know that you can never have enough recipes. The Homebrewer’s Recipe Guide will slake your thirst for more than 175 different beers in a variety of styles, whether you prefer a classic lager, a brown ale, a fruity brew, or a flavored stout. Among the original recipes are:-Any Pub in London Bitter, a classic ale with a strong hop flavor-Viennese Spiced Porter, a rich creamy porter with a hint of vanilla-Golden Pils, a beer less dry than the classic pilsner-Holiday and seasonal beers like Firecracker Red (with its cinnamon kick), the Great Pumpkin Ale, and Holiday Prowler Beer—the perfect gift-Brewery Copycats—re-create your favorite tastes-Foods featuring homebrew as an ingredient, like Red-Hot Rack of Ribs, Frijoles Borrachos, and classic Oatmeal Beer BreadRich quotations from Hemingway, Shakespeare, Joyce, and others celebrate memorable libations, special drinking spots, and other bits of beer and tavern lore and legend. Created by experienced homebrewers and filled with helpful tips, The Homebrewer’s Recipe Guide is a must-have reference for both novice and expert alike.

Travels with Barley: A Journey Through Beer Culture in America

by Ken WellsDo beer yeast rustlers really exist? Who patented the Beer Goddess? How can you tell a Beer Geek from a Beer Nazi? Where exactly is Beervana? Does Big Beer hate Little Beer? Ken Wells, a novelist, Pulitzer Prize finalist, and longtime Wall Street Journal writer, answers these questions and more by bringing a keen eye and prodigious reportage to the people and passions that have propelled beer into America's favorite alcoholic beverage and the beer industry into a $75 billion commercial juggernaut, not to mention a potent force in American culture. Travels with Barley is a lively, literate tour through the precincts of the beer makers, sellers, drinkers, and thinkers who collectively drive the mighty River of Beer onward. The heart of the book is a journey along the Mississippi River, from Minnesota to Louisiana, in a quixotic search for the Perfect Beer Joint -- a journey that turns out to be the perfect pretext for viewing America through the prism of a beer glass. Along the river, you'll visit the beer bar once owned by the brewer Al Capone, glide by The World's Largest Six Pack, and check into Elvis Presley's Heartbreak Hotel to plumb the surprisingly controversial question of whether Elvis actually drank beer. But the trip also includes numerous detours up quirky tributaries, among them: a visit to an Extreme Beer maker in Delaware with ambitions to make 50-proof brew, a look at the murky world of beer yeast rustlers in California, and a journey to the portals of ultimate beer power at the Anheuser-Busch plant in St. Louis, where making the grade as a Clydesdale draft horse is harder than you might imagine. Entertaining, enlightening, and written with Wells's trademark verve, Travels with Barley is a perfect gift -- not just for America's 84 million beer enthusiasts, but for all discerning readers of flavorful nonfiction.

The Idolatry of God: Breaking Our Addiction to Certainty and Satisfaction

by Peter RollinsYou can’t be satisfied. Life is difficult. You don’t know the secret.Whether readers are devout believers or distant seekers, The Idolatry of God shows that we must lay down our certainties and honestly admit our doubts to identify with Jesus. Rollins purposely upsets fundamentalist certainty in order to open readers up to a more loving, active manifestation of Christ’s love. In contrast to the usual understanding of the “Good News” as a message offering satisfaction and certainty, Rollins argues for a radical and shattering alternative. He explores how the Good News actually involves embracing the idea that we can’t be whole, that life is difficult, and that we are in the dark. Showing how God has traditionally been approached as a product that will render us complete, remove our suffering, and reveal the answers, he introduces an incendiary approach to faith that invites us to joyfully embrace our brokenness, resolutely face our unknowing, and courageously accept the difficulties of existence. Only then, he argues, can we truly rob death of its sting and enter into the fullness of life.

A Grand Complication: The Race to Build the World's Most Legendary Watch

by Stacy PermanTwo wealthy and powerful men engage in a decades-long contest to create and possess the most remarkable watch in history.James Ward Packard of Warren, Ohio, was an entrepreneur and a talented engineer of infinite curiosity, a self-made man who earned millions from his inventions, including the design and manufacture of America&’s first luxury car—the elegant and storied Packard. Henry Graves, Jr., was the very essence of blue-blooded refinement in the early 1900s: son of a Wall Street financier, a central figure in New York high society, and a connoisseur of beautiful things—especially fine watches. Then, as now, expensive watches were the ultimate sign of luxury and wealth, but in the early twentieth century the limitless ambition, wealth, and creativity of these two men pushed the boundaries of mathematics, astronomy, craftsmanship, technology, and physics to create ever more ingenious timepieces. In any watch, features beyond the display of hours, minutes, and seconds are known as &“complications.&” Packard and Graves spurred acclaimed Swiss watchmaker Patek Philippe to create the Mona Lisa of timepieces—a fabled watch that incorporated twenty-four complications and took nearly eight years to design and build. For the period, it was the most complicated watch ever created. For years it disappeared, but then it surfaced at a Sotheby&’s auction in 1999, touching off a heated bidding war, shattering all known records when it fetched $11 million from an anonymous bidder.New York Times bestselling author Stacy Perman takes us from the clubby world of New York high society into the ateliers of the greatest Swiss watchmakers, and into the high-octane, often secretive subculture of modern-day watch collecting. With meticulous research, vivid historical details, and a wealth of dynamic personalities, A Grand Complication is the fascinating story of the thrilling duel between two of the most intriguing men of the early twentieth century. Above all, it is a sweeping chronicle of innovation, the desire for beauty, and the lengths people will go to possess it.

The Life and Rhymes of Benjamin Zephaniah: The Autobiography

by Benjamin Zephaniah*BBC Radio 4 Book of the Week* Benjamin Zephaniah, who has travelled the world for his art and his humanitarianism, now tells the one story that encompasses it all: the story of his life. In the early 1980s when punks and Rastas were on the streets protesting about unemployment, homelessness and the National Front, Benjamin&’s poetry could be heard at demonstrations, outside police stations and on the dance floor. His mission was to take poetry everywhere, and to popularise it by reaching people who didn&’t read books. His poetry was political, musical, radical and relevant. By the early 1990s, Benjamin had performed on every continent in the world (a feat which he achieved in only one year) and he hasn&’t stopped performing and touring since. Nelson Mandela, after hearing Benjamin&’s tribute to him while he was in prison, requested an introduction to the poet that grew into a lifelong relationship, inspiring Benjamin&’s work with children in South Africa. Benjamin would also go on to be the first artist to record with The Wailers after the death of Bob Marley in a musical tribute to Nelson Mandela.The Life and Rhymes of Benjamin Zephaniah is a truly extraordinary life story which celebrates the power of poetry and the importance of pushing boundaries with the arts.

Loosed upon the World: The Saga Anthology of Climate Fiction

by Margaret Atwood Paolo Bacigalupi Seanan McGuireCollected by the editor of the award-winning Lightspeed magazine, the first, definitive anthology of climate fiction—a cutting-edge genre made popular by Margaret Atwood.Is it the end of the world as we know it? Climate Fiction, or Cli-Fi, is exploring the world we live in now—and in the very near future—as the effects of global warming become more evident. Join bestselling, award-winning writers like Margaret Atwood, Paolo Bacigalupi, Kim Stanley Robinson, Seanan McGuire, and many others at the brink of tomorrow. Loosed Upon the World is so believable, it’s frightening.

The Nominee (Jack Flynn #2)

by Brian McGroryWashington press insider Brian McGrory, whose debut novel, The Incumbent, soared onto the national bestseller lists amid rave reviews, is back with a second sizzling political thriller featuring Jack Flynn, the intrepid newspaperman with the wry turn of phrase. News is crackling all around him when Jack Flynn, ace reporter for The Boston Record, is summoned to a secret meeting with his esteemed publisher, Paul Ellis. Ellis sadly reveals that the newspaper they both love, owned by his family for more than a century, is the target of a hostile takeover bid by a shadowy corporate chain. Desperate, he asks for Jack's help. Already on the brink of a hot political scoop, Jack sets out in pursuit of a hidden truth. But that very day his life is threatened. The Record is beset by horrific tragedy. And a death from years ago no longer appears what it once seemed. Now Jack is forced to question not only the words published in his own paper but the relationships that have been the bedrock of his life -- in particular those with his gorgeous ex-girlfriend, who writes for a rival tabloid, and with the venerable Record reporter Robert Fitzgerald, Jack's longtime mentor. And all along, Jack is sitting on a goldmine of information that could torpedo the president's controversial nomination of the Massachusetts governor to be the next U.S. Attorney General. As he balances on a tightrope of personal and professional peril, shuttling from the swamps of central Florida to the corridors of Congress, then back to the alleyways of Boston, Jack is left with just two questions: Will his newspaper survive long enough for him to tell his story? Will he? Combining breakneck speed and tension-packed plotting with the insights of a consummate political insider, Brian McGrory explores the ethics and direction of modern journalism and analyzes how, in this era of media saturation, reputations are made and too often destroyed. The Nominee, peopled with irresistible characters that linger long after the last page is turned, confirms his position at the forefront of today's most talented young suspense writers.

Amaze Us, O God!: Experiencing the Miraculous

by Mark Hanby Roger Roth Sr.Discover the twelve spiritual keys that unlock divine portals between heaven and earth in this profound book offering wisdom for a new vision of life.In this amazing book, Dr. Mark Hanby shares twelve spiritual keys that will open the doors to God&’s miraculous intervention into life here on earth. Based on years of his own personal experience and the testimony of other amazed believers, Hanby opens his life and ministry to share these easily accessible but precious keys.God&’s blessings are waiting for you—He desires to rain them down in abundant living. As you step out in faith—expecting God to meet you right where you are—you will discover the amazing world of God&’s outpouring.

Molly's Christmas Orphans: Can She Save A Family This Christmas? The Must-read Christmas Family Saga For 2019

by Carol RiversFrom the Sunday Times and ebook bestselling author of A Wartime Christmas comes a gritty and nostlagic family saga about love, loss and keeping family together. 'Surely one of the best saga writers of her time' – Rosie Clarke1940. Molly Swift, at 27, has already suffered the tragic loss of her two-year-old daughter Emily, to the flu outbreak of 1935. Now she waits for news of her shopkeeper husband Ted, who volunteered for the British Expeditionary Forces at the outbreak of war. Molly is intent on running the general store with the help of her retired father, Bill Keen and ex-proprietor of the business. But after the building is hit during a bombing raid and Bill is severly injured, Molly faces difficult times. Alone in the hospital corridor as Bill is treated, Molly tries to keep positive. But the Blitz is well underway and she is forced to take shelter in the hospital&’s basement. It&’s here, as the bombs fall around docklands, that Molly meets Andy Miller and his two young children, Evie and Mark. An unlikely friendship begins as Molly offers the homeless group safe lodgings for the following night, and soon their lives are entwined, bringing unexpected joy and heartache for them all.Praise for CAROL RIVERS:'A gripping page turner' - LEAH FLEMING'Brings the East End to life - family loyalties, warring characters and broken dreams. Superb' - ELIZABETH GILL

Mindy Kim, Class President (Mindy Kim Ser. #4)

by Lyla LeeFresh Off the Boat meets Junie B. Jones in the adorable chapter book series following Mindy Kim, a young Asian American Girl—in this fourth novel, Mindy runs for class president!It&’s time to pick a class president, and Mindy really wants to win—and she&’s basing her entire campaign on snacks and being kind, so how could she NOT be chosen?But there is one big thing that Mindy is not sure she can do—make a speech to her class about why she would be the best pick for president. Can Mindy face her fears and show the class—and herself—that she can be the best class president ever?

The Royal Ball: The Newest Princess; The Royal Ball; The Puppy Prince; Star Showers (Itty Bitty Princess Kitty #2)

by Melody MewsItty must learn to dance before her first royal ball in this second adorable book in the Itty Bitty Princess Kitty chapter book series!There&’s going to be a royal ball at the palace! The ball is when Itty will present herself as princess for the first time. Itty also has to teach all of Lollyland a new dance on the spot. There&’s just one problem. Itty has no idea how to dance! Will the princess figure something out, or will she dance her way into disaster?With easy-to-read language and illustrations on every page, the Itty Bitty Princess Kitty chapter books are perfect for emerging readers.

Unexpected Gifts: Discovering the Way of Community

by Christopher L. HeuertzIn this heartfelt and thoughtful book, Christopher Heuertz writes of the dangers of isolation, the challenges we face when we join together and the struggles and joys that emerge from genuine community bonding.“Ironically, as much as we yearn for deep friendships and meaningful communities, many of us seem to be unable to find our way into them. Even if we know we’re made for community, finding one and staying there seems almost impossible. Though we hate to admit it, if we stay long enough in any relationship or set of friendships, we will experience failure, doubt, burnout, loneliness, transitions, a loss of self, betrayal, frustration, a sense of entitlement, grief, and weariness. Yet it’s these painful community experiences, these tensions we struggle to navigate, that hold surprising gifts.” —FROM THE PREFACE IN A STRIKINGLY confessional tone and vividly illustrated through story, Unexpected Gifts names eleven inevitable challenges that all friendships, relationships, and communities experience if they stay together long enough. Rather than allowing these challenges to become excuses to leave, Chris Heuertz suggests that things like betrayal, transitions, failure, loss of identity, entitlement, and doubt may actually be invitations to stay. And if we stay, these challenges can become unexpected gifts. *** Betrayal, failure, loss of identity, doubt. If your relationships have suffered from any of these pitfalls, this book will show you that staying together can create something more—even something beautiful. IN THIS HEARTFELT and thoughtful book, Christopher Heuertz writes of the dangers of isolation, the challenges we face when we join together, and the struggles and joys that emerge from genuine community bonding. Whether readers are forming a new community, searching for deeper community, or participating in a longtime community, they will find inspiration, caution, guidance, and encouragement as they discover the beauty of pressing in to the ambiguities of growing relationships in this tender and honest testimony about how we are woven together by grace.

Daughters of Fortune: A Novel

by Tara HylandA FASHION DYNASTY AT WARWilliam Melville’s daughters are heiresses to the world’s most exclusive fashion dynasty. Beautiful and rich, they are envied by all. But behind the glittering façade of their lives, each girl hides a dark secret that threatens to tear their family apart.Smart, ambitious Elizabeth knows how to manipulate every man she meets, except the one who counts: her father.Gentle, naïve Caitlin, the illegitimate child, struggles to fit into a world of privilege while staying true to herself.Stunning, spoiled Amber, the party girl with a weakness for bad boys; more fragile than anyone realizes.As each of them seeks to carve out her own destiny, Elizabeth, Caitlin, and Amber face difficult choices, which will take them in wildly different directions. But as old wounds resurface and threaten to destroy the foundations of the Melville empire, their paths will cross again. Because the simple truth is that, no matter how far you go, you cannot escape the claims of family.

Thrive, Don't Simply Survive: Passionately Live the Life You Didn't Plan

by Karol LaddLife is unpredictable and often doesn't turn out as we'd planned. The things that matter most to us -- marriages, children, careers, families, and friends -- sometimes fall apart and leave us only with deflated dreams. Whether you're struggling with the big issues of life or simply overwhelmed by the demands of every single day, Karol Ladd's powerful biblical principles will give you the help you need. In this book, you will discover how to redefine your unexpected life, and you'll learn concrete skills that will help you move past simply surviving and into a thriving life that is lived passionately and with joy. New purpose and hope await you just beyond the cover of this book.

The Greatest Game: The Yankees, The Red Sox, And The Playoff Of '78

by Richard BradleyIn this spellbinding book, Richard Bradley tells the story of what was surely the greatest major league game of our lifetime and perhaps in the history of professional baseball. That game, played at Fenway Park on the afternoon of October 4, 1978, was the culmination of one of the most tense, emotionally wrought seasons ever, between baseball's two most bitter rivals, the Boston Red Sox and the New York Yankees. Both teams finished this tumultuous season with identical 99-64 records, forcing a one-game playoff. With a one-run lead and two outs, with the tying run in scoring position in the bottom of the ninth, the entire season came down to one at-bat and to one swing of the bat. It came down, as both men eerily predicted to themselves the night before, to the aging Red Sox legend, Carl Yastrzemski, and the Yankees' free-agent power reliever, Rich "Goose" Gossage. Anyone who calls himself a baseball fan knows the outcome of that confrontation. And yet such are the literary powers of the author that we are pulled back in time to that late-afternoon moment and become filled anew with all the taut sense of drama that sports has to offer, as if we don't know what happened. As if the thoughts swirling around in the heads of pitcher and hitter are still fresh, both still hopeful of controlling events. That climactic game occurred thirty seasons ago and yet it still captures our imagination. In this delightful work of sports literature, we watch the game unfold pitch by pitch, inning by inning, but Bradley is up to something more ambitious than just recounting this wonderful game. He also tells us the stories of the participants -- how they got to that moment in their lives and careers, what was at stake for them personally -- including the rivalries within the rivalry, such as catcher Carlton Fisk versus catcher Thurman Munson,and Billy Martin versus everyone. Using a narrative that alternates points of view between the teams, Bradley reacquaints us with a rich roster of characters -- Freddy Lynn, Ron Guidry, Catfish Hunter, Mike Torrez, Jerry Remy, Lou Piniella, George Scott, and Reggie Jackson. And, of course, Bucky Dent, who craved just such a moment in the sun -- a validation he had vainly sought from the father he barely knew. Not a book intended to celebrate a triumph or lament a loss, The Greatest Game will be embraced in both Boston and New York, with fans of both teams recalling again the talented young men they once gave their hearts to. And fans everywhere will be reminded how utterly gripping a single baseball game can be and that the rewards of being a fan lie not in victory but in caring beyond reason, even decades after the fact.

Telecosm: The World After Bandwidth Abundance

by George GilderThe computer age is over. After a cataclysmic global run of thirty years, it has given birth to the age of the telecosm -- the world enabled and defined by new communications technology. Chips and software will continue to make great contributions to our lives, but the action is elsewhere. To seek the key to great wealth and to understand the bewildering ways that high tech is restructuring our lives, look not to chip speed but to communication power, or bandwidth. Bandwidth is exploding, and its abundance is the most important social and economic fact of our time. George Gilder is one of the great technological visionaries, and "the man who put the 's' in 'telecosm'" (Telephony magazine). He is equally famous for understanding and predicting the nuts and bolts of complex technologies, and for putting it all together in a soaring view of why things change, and what it means for our daily lives. His track record of futurist predictions is one of the best, often proving to be right even when initially opposed by mighty corporations and governments. He foresaw the power of fiber and wireless optics, the decline of the telephone regime, and the explosion of handheld computers, among many trends. His list of favored companies outpaced even the soaring Nasdaq in 1999 by more than double. His long-awaited Telecosm is a bible of the new age of communications. Equal parts science story, business history, social analysis, and prediction, it is the one book you need to make sense of the titanic changes underway in our lives. Whether you surf the net constantly or not at all, whether you live on your cell phone or hate it for its invasion of private life, you need this book. It has been less than two decades since the introduction of the IBM personal computer, and yet the enormous changes wrought in our lives by the computer will pale beside the changes of the telecosm. Gilder explains why computers will "empty out," with their components migrating to the net; why hundreds of low-flying satellites will enable hand-held computers and communicators to become ubiquitous; why television will die; why newspapers and magazines will revive; why advertising will become less obnoxious; and why companies will never be able to waste your time again. Along the way you will meet the movers and shakers who have made the telecosm possible. From Charles Townes and Gordon Gould, who invented the laser, to the story of JDS Uniphase, "the Intel of the Telecosm," to the birthing of fiberless optics pioneer TeraBeam, here are the inventors and entrepreneurs who will be hailed as the next Edison or Gates. From hardware to software to chips to storage, here are the technologies that will soon be as basic as the air we breathe.

Heidi Heckelbeck and the Christmas Surprise: Heidi Heckelbeck Has A Secret; Casts A Spell; And The Cookie Contest; In Disguise; Gets Glasses; And The Secret Admirer; Is Ready To Dance!; Goes To Camp!; And The Christmas Surprise; And The Tie-dyed Bunny (Heidi Heckelbeck #9)

by Wanda CovenWhen Heidi gets in some Christmastime trouble, it will take more than magic to restore the holiday spirit!Christmas is around the corner, and Heidi is very excited. She loves Christmas decorations, Christmas cookies, and, best of all, Christmas presents! But when she takes her mom’s special charm bracelet without asking—and then loses it—Heidi fears that her mom will be angry with her. And when she finally finds the bracelet, it has been totally crushed by a snowplow. Heidi tries to fix the broken bracelet with a spell, but that only makes things worse! Will Heidi have the courage to come clean and tell her mom the truth—and will there still be room for Christmas cheer?With easy-to-read language and illustrations on almost every page, the Heidi Heckelbeck chapter books are perfect for beginning readers.

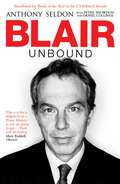

Blair Unbound

by Anthony Seldon Peter Snowdon Daniel CollingsThe first volume of Anthony Seldon's riveting and definitive life of Tony Blair was published to great acclaim in 2004. Now, as the Labour Party and the country get used to the idea of a new leader and a new Prime Minister,Seldon delivers the most complete, authoritative and compelling account yet ofthe Blair premiership. Picking up the story in dramatic fashion on 11 September 2001, Seldon recaps very briefly Blair's trajectory to what may now be regarded as the high-point of his leadership, and then brings us right up to date as Blair hands over the reins to hisarch-rival, Gordon Brown. Based on hundreds of original interviews with key insiders, many of whose views have hitherto been kept private, BLAIR UNBOUND serves both as a fascinating 'volume two' of this masterclass in political biography and a highly revealing and compelling book in its own right.